AUD/USD Signal Update

Yesterday’s signals expired without being triggered.

Today’s AUD/USD Signals

Risk 0.75%

Trades may only be taken between 8am and 5pm New York time only, or after 8am Tokyo time later.

Short Trade 1

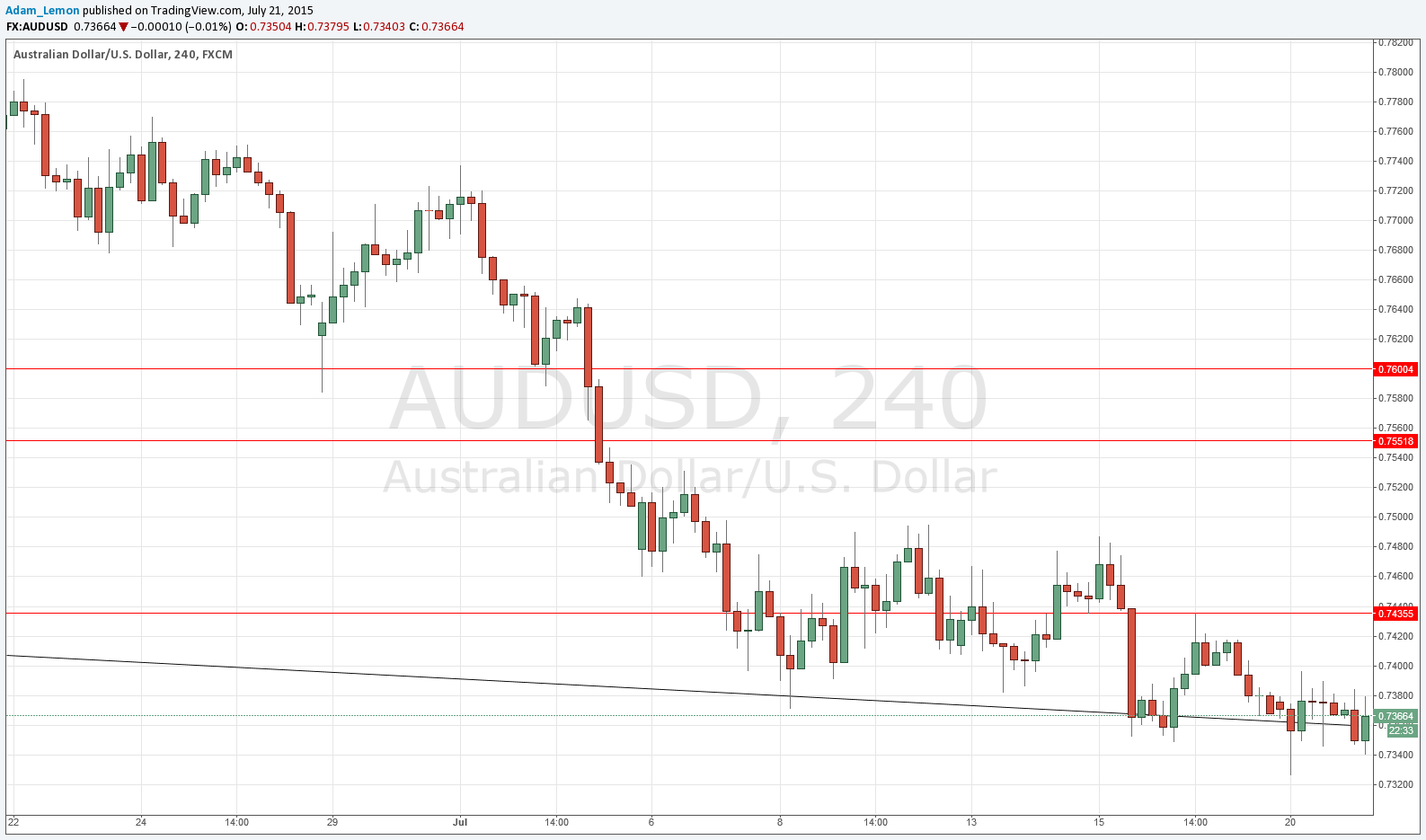

Go short following some bearish price action on the H1 time frame immediately upon the next touch of 0.7435.

Put the stop loss 1 pip above the local swing high.

Adjust the stop loss to break even once the trade is 20 pips in profit.

Remove 50% of the position as profit when the trade is 20 pips in profit and leave the remainder of the position to run.

Short Trade 2

Go short following some bearish price action on the H1 time frame immediately upon the next touch of 0.7552.

Put the stop loss 1 pip above the local swing high.

Adjust the stop loss to break even once the trade is 20 pips in profit.

Remove 50% of the position as profit when the trade is 20 pips in profit and leave the remainder of the position to run.

AUD/USD Analysis

There was a bit of a pullback yesterday, then during the Australian session that just ended, the RBA signalled quite subtly that there are no more interest rate cuts coming quite soon. If they had said something different, this pair probably would have fallen quite hard, but as they did not, then instead the price is not really going anywhere.

Technically I have kept the trend line in the chart and it may be that this line is providing some subtly support, however the action is fairly choppy and it seems the bullish USD is moving ahead more smoothly against the CAD and especially the JPY for the time being.

I would still keep a short bias with the two levels above given as good places for pull backs to reverse back into the prevailing downwards trends.

There is nothing due today regarding the USD. Concerning the AUD, CPI data will be released at 2:30am London time. Later at 4:05 the Governor of the RBA will be speaking.