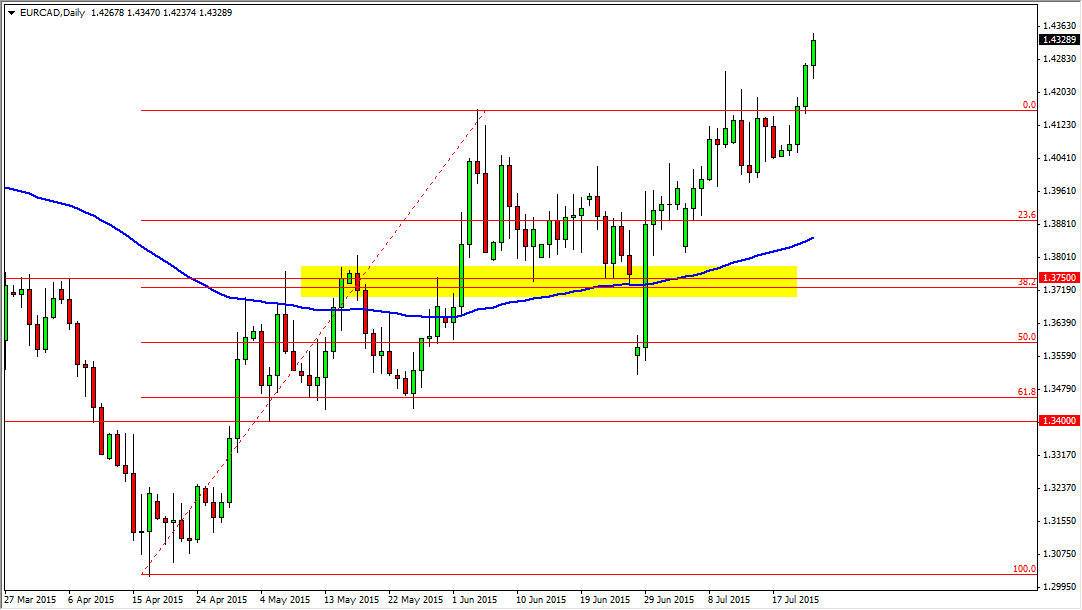

The EUR/CAD pair broke higher during the session on Thursday, as we continue to see the uptrend in this pair. The Euro has been breaking higher all day, and as a result it makes perfect sense that we should continue to go higher. This also is compounded by the fact that the Canadian dollar continues to struggle. The crude oil markets are falling, and as a result the Canadian dollar has no real support at this point in time. The pair has been breaking higher for some time, so this is just simple continuation.

The 1.43 level being broken is a good sign as well, as the consolidation was broken to release the buyers. This pair should now go to the 1.45 level next, as it is resistance on the longer-term charts. It is also the large, round, and significant number due to psychology of it.

Buying pullbacks

I am buying pullbacks in this pair, as the markets should continue to reach to higher levels, but there will also be a lot of volatility. In fact, the markets should continue to show volatility, as we are certainly prone to seeing it in the summer, and especially since the European Union has just emerged from so much trouble in Greece. There is of course going to be a bit of a relief rally, but it could be more than that before it is all said and done. After all, Canada doesn’t look good at the moment.

I am not interested in selling at this point, and to be honest would have to see this market fall all the way below the 1.3750 level in order to do so. The 100 exponential moving average is just above there as well, so this would be a break of several technical barriers of support. With this, I feel confident in the uptrend, and that it will continue. Oil can only help at this point as well….