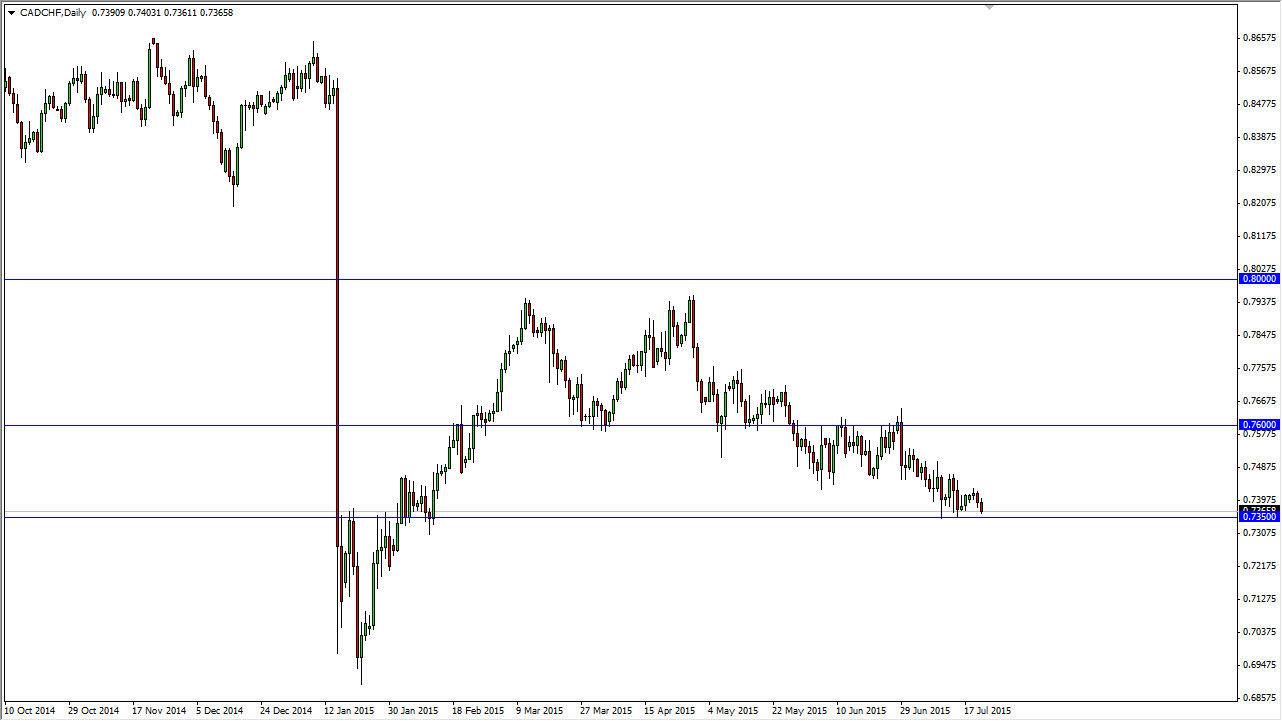

During the session on Wednesday, the CAD/CHF pair fell during the course of the day. Granted, it wasn’t a massive move lower, but the one thing that I am cognizant of is the fact that the Canadian dollar itself is getting pummeled as the oil markets simply cannot rally at all. In fact, the WTI Crude Oil markets broke down below the $50 level, and that of course is a very technically bearish signal. With that, Forex traders sold off the Canadian dollar overall as it is used as a proxy for petroleum markets quite often.

The 0.7350 level below is massively supportive, so will take a little bit of momentum to break down below there. However, everything on this chart is pointing to that happening, so if we can get below that level for more than about an hour, I would start shorting this market as we could very easily head back down to the 0.72 level, and then possibly the 0.70 handle.

Rallies should be sold

I believe that rally should be sold as we may get a little bit of a “relief rally” from time to time, but ultimately we have been selling off in a rather steady manner for some time. However, do not look for some type of meltdown in this market, because the Swiss National Bank has been shorting the Swiss franc in the spot Forex markets lately. Granted, it is found in the EUR/CHF pair, but it does have a little bit of an effect on the Swiss franc overall against most currencies.

Once we get a significant breakdown in the oil markets that will more than likely be enough to break down below the 0.7350 handle. Quite frankly, I feel that it’s only a matter of time before this happens, so I don’t really have a scenario for buying this market as it is far too negative and strong to the downside in order to try to fight that move lower.