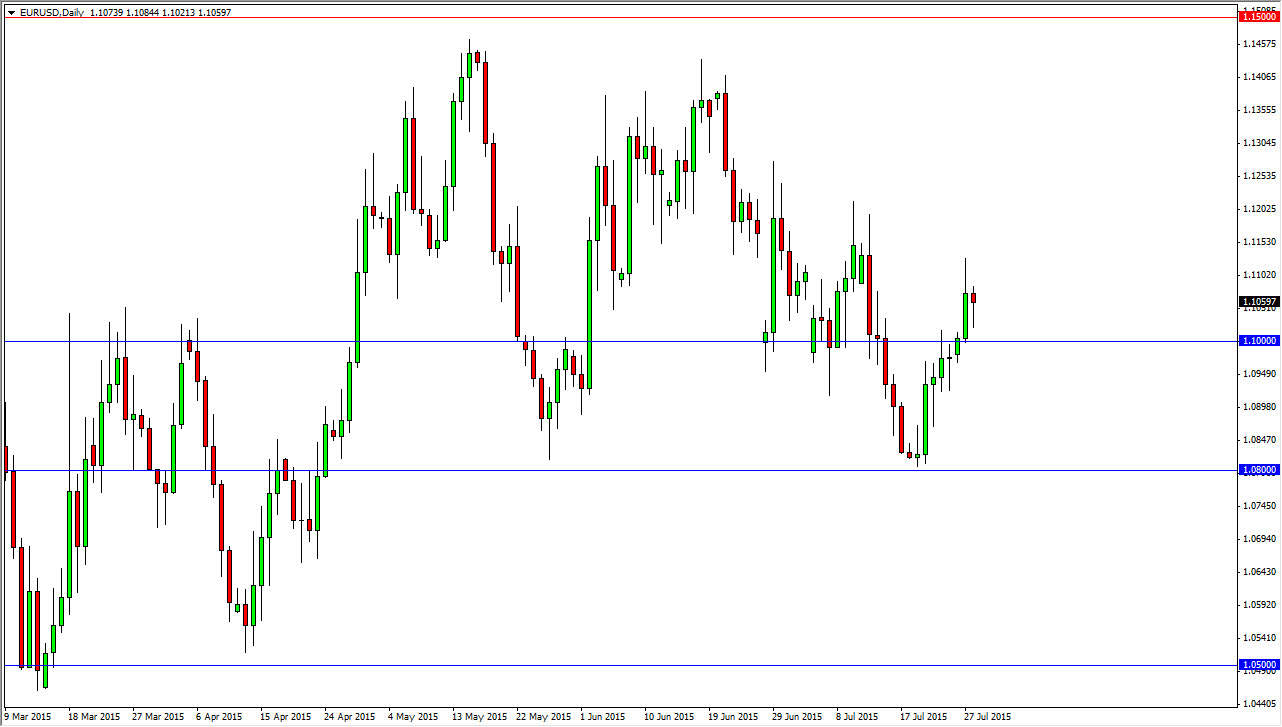

The EUR/USD pair found support after falling during the Tuesday session near the 1.10 level. This is an area that previously offered resistance, so the fact that it offers support at this point in time doesn’t surprise me at all. We bounced off of that level and formed a hammer, which of course is fairly bullish. I believe that if we can break the top of the hammer for the Tuesday session, we will probably go to the next resistance barrier at the 1.12 handle.

Volatility remains as the US dollar of course is favored against some currencies, while the Euro seems to be getting a bit of a reprieve due to the “solution” to the Greek debt crisis. With this, I think it’s only a matter of time before the sellers return to this market though, because quite frankly it does not seem as if the markets are completely convinced that the Greece situation is even close to being done.

Short-term trading

I believe that short-term trading is about the only thing you can do in this market, and as a result I would actually be using the daily charts as a guidepost for trades off of the one hour chart. I believe that pullbacks towards the 1.10 level offer buying opportunities if we can find support. On the other hand, if we break down below that level I would be a seller as I think the market would then head back to the 1.08 handle, an area that has been rather supportive. The matter what, I cannot imagine being married to a position in this market, as it is not only volatile due to the situation in Greece, but quite frankly this time of year has very little in the way of conviction most of the time, and this year of course doesn’t seem to be any different than most others. With this, I remain somewhat neutral in this pair but recognize that we have some range bound trading to do from time to time.