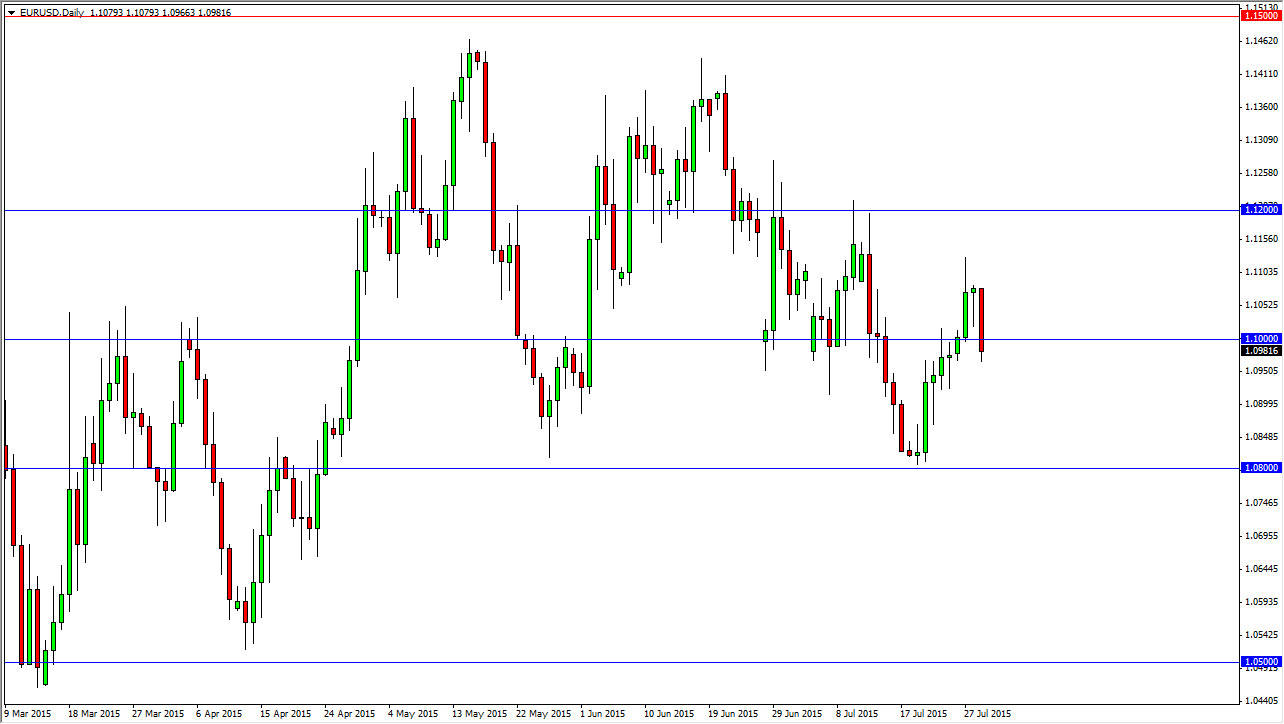

The EUR/USD pair broke down during the course of the session on Monday, and on top of that broke down below the bottom of the hammer from the Tuesday session. With that being the case, the market has essentially turned the Tuesday candle into a “hanging man.” This of course is a very negative sign, but even more negative for me is the fact that we broke down below the 1.10 level. That area should have been supportive, and the fact that we broke down below there suggests that perhaps this market will go a bit lower. I found this a bit interesting, because the Federal Reserve looks as if it is ready to raise rates sometime later this year, but that’s not anything new. We have the FOMC Statement that came out during the course of the session on Wednesday, which essentially just reiterated everything that we already know. Quite frankly, I was surprised to see this reaction.

1.10 is essentially “fair value.”

I believe that the 1.10 level is essentially fair value in this pair, and as a result the market will continue to be attracted to that level. However, if we break down below the bottom of the range for the Wednesday session, I feel that this market probably grind its way down to the 1.09 level, and then the 1.08 level. Because of this, I think short-term traders would get involved and start shorting this market initially, but eventually the market would find support below that people would start buying.

A break above the 1.10 level is bullish, but I also recognize that it is going to be choppy matter what happens, and the 1.10 level above is the target, with the 1.12 level above being a longer-term target. It is the middle the summer though, so quite frankly it doesn’t surprise me that we would be choppy going forward, and therefore I am trading smaller positions, and on smaller time frames than per usual.