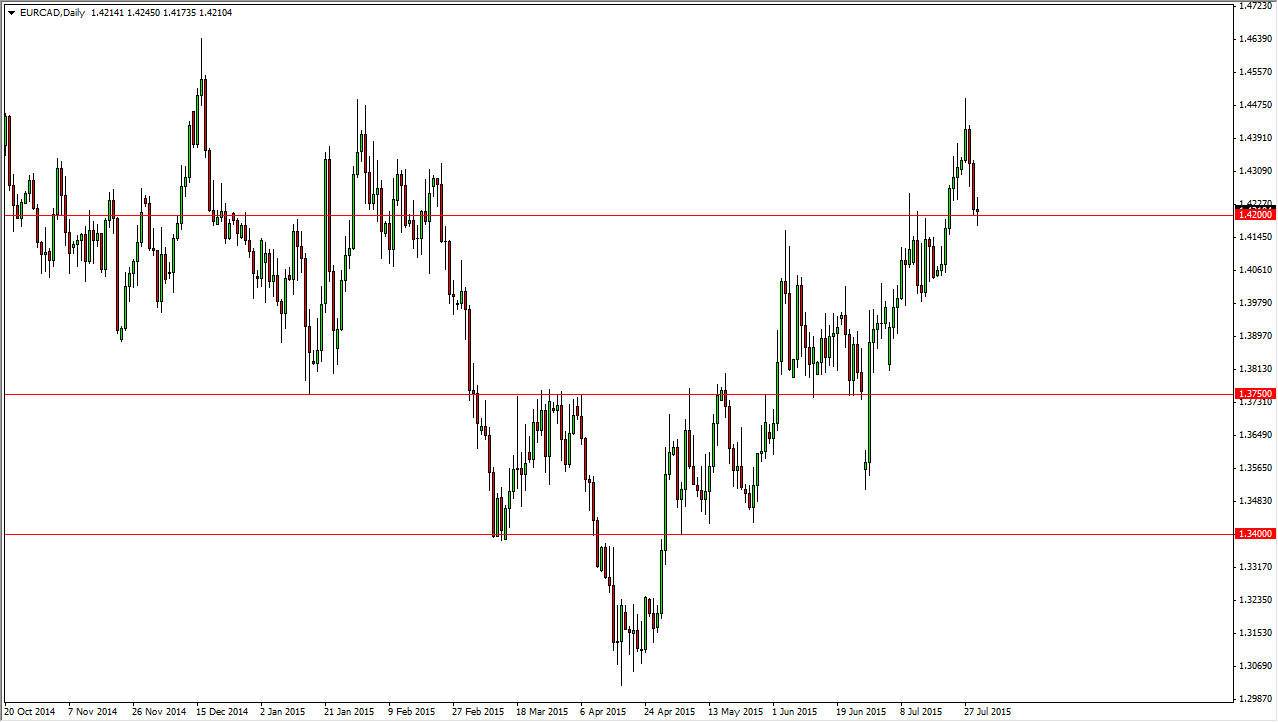

The EUR/CAD pair has been grinding its way higher for some time now, but the last couple of sessions had been rather brutal when it comes to the Euro. Ultimately, the market looks as if it is going to continue to go higher, probably heading towards the 1.45 level. The fact that we formed a neutral candle during the session of course suggests that perhaps the 1.42 level will be supportive enough to keep the market somewhat afloat, and as a result I would be a buyer if we break above the top of that range. If we do get that though, I think that the Canadian dollar will continue to be punished as it is a proxy for the crude oil markets which of course aren’t necessarily going fairly well.

Crude oil

Speaking of crude oil, that market does look very soft at the moment, and that of course will continue to work against the value the Canadian dollar. Also, the Canadians recently had an interest-rate cut out of the blue, and that of course will work against the value of the currency in general. As long as commodities are fairly soft, I don’t think that you can buy the CAD, NZD, or the AUD for any real length of time. With that, I believe that even though the Euro is significantly be down and certainly one of the weaker currencies out there, the truth of the matter is that commodity markets are very soft and should continue to be.

Even if we break down below the bottom of the range for the session on Thursday, I think there’s enough support only down to at least the 1.40 level to consider buying a supportive candle below as well. At this point in time, I don’t really have a scenario in which I want to sell this pair, as the oil markets have been so soft and are so far away from turning around and having an uptrend.