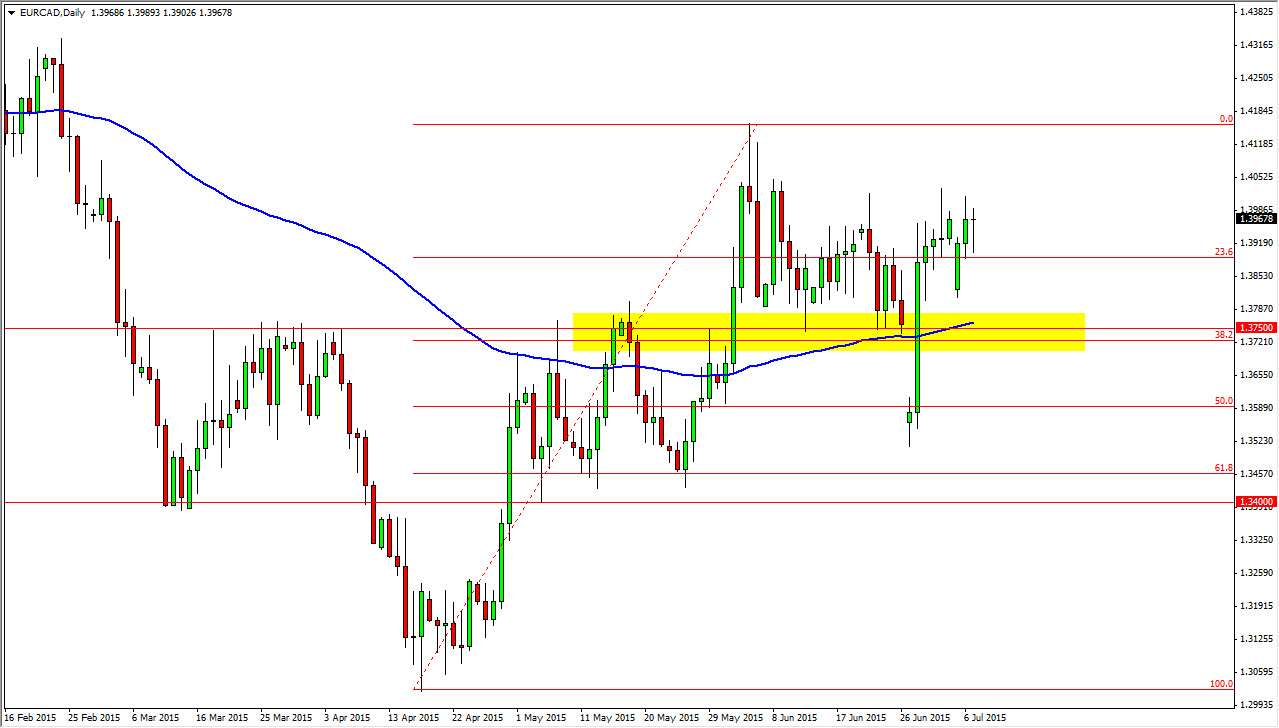

The EUR/CAD pair initially tried to fall during the session on Tuesday, but found enough support near the 1.39 level to turn things back around and form a hammer. Looking at the charts, I cannot help but notice that the Canadian dollar itself is getting pummeled at the moment, so the idea of this pair going higher isn’t exactly a real stretch of the imagination. On the attached chart, I have a Fibonacci retracement tool drawn, and as a result you can see that the 38.2% Fibonacci retracement level was rather supportive. On top of that, what we did gapped down, it was the 50% Fibonacci retracement level that offered the support to turn things back around.

Looking at the chart, you can see that I have the 38.2% Fibonacci retracement level highlighted, and the 100 day exponential moving average is at the same level as well. On top of that, we did up forming a hammer, which of course is a very supportive candle for the session on Tuesday. I think it’s only a matter of time before we break out to the upside.

Oil markets

Oil markets have absolutely, and done. With that being the case, the market will more than likely punish the Canadian dollar as it is so highly leveraged to the petroleum industry. Remember, a lot of currency traders will use the Canadian dollar as a proxy for oil, and as a result the currency rises and falls with the oil futures markets.

With this, I would anticipate this market to go higher, and as a result the market will probably head towards the 1.4250 level next. The 1.40 level just above of course is going to be a little bit resistive mainly because of the large, round, psychologically significant number, but at the end of the day it’s probably a market that will grind its way through there. Ultimately, I believe that this market will head towards the 1.45 level, and beyond. This will be especially true if the Greece situation calms down.