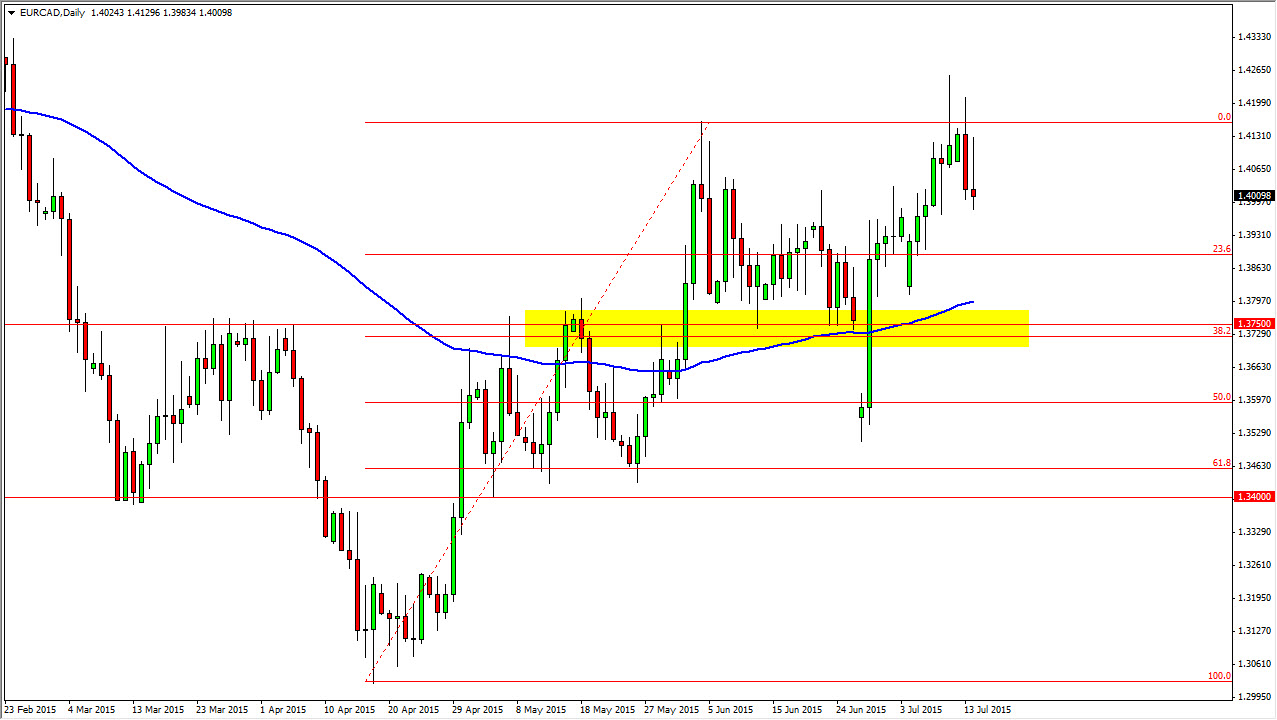

The EUR/CAD pair broke higher during the course of the session on Tuesday, but turned back around to form a shooting star. The shooting star of course suggests that there is going to be bearish pressure, and I find this interesting considering that today is going to be very important for the Canadian dollar in general. After all, there is a Canadian interest-rate decision coming out of the Bank of Canada, which of course can move the Canadian dollar in general.

This pair is going to be especially interesting, because we have all of the questions about what’s coming for Europe, and course the interest-rate decision and what’s going on in the oil markets. Remember, oil markets have a lot to do with what happens with the Canadian dollar, as the Canadians are such a large exporters of that particular commodity. As a result, most Forex traders use the Canadian dollar as a proxy for trading crude oil itself.

Volatility

I believe that this market will continue to show volatility regardless, just simply because of the oil markets showing such back and forth volatility, which of course finds itself showing the same thing in the Canadian dollar in general. With that, you have to keep in mind that the Euro will continue to show a lot of volatility due to the fact that the market has to wonder whether or not the Greeks are going to finally fix the debt crisis, which seems unlikely, or that the Germans will continue to press the issue. While there is a short-term fix yet again, we don’t have any long-term fixes in place and that of course has people nervous.

Having said that, it does look like there is a significant amount of support below though, so what we believe is that a supportive candle closer to the 1.39 level would be a nice buying opportunity. I believe that the 1.3750 level below is supportive, and the 100 day exponential moving average in that general vicinity will also bring in buyers. So while I feel that this market drops from here, I think it’s only a matter of time before the buyers come back into the fold.