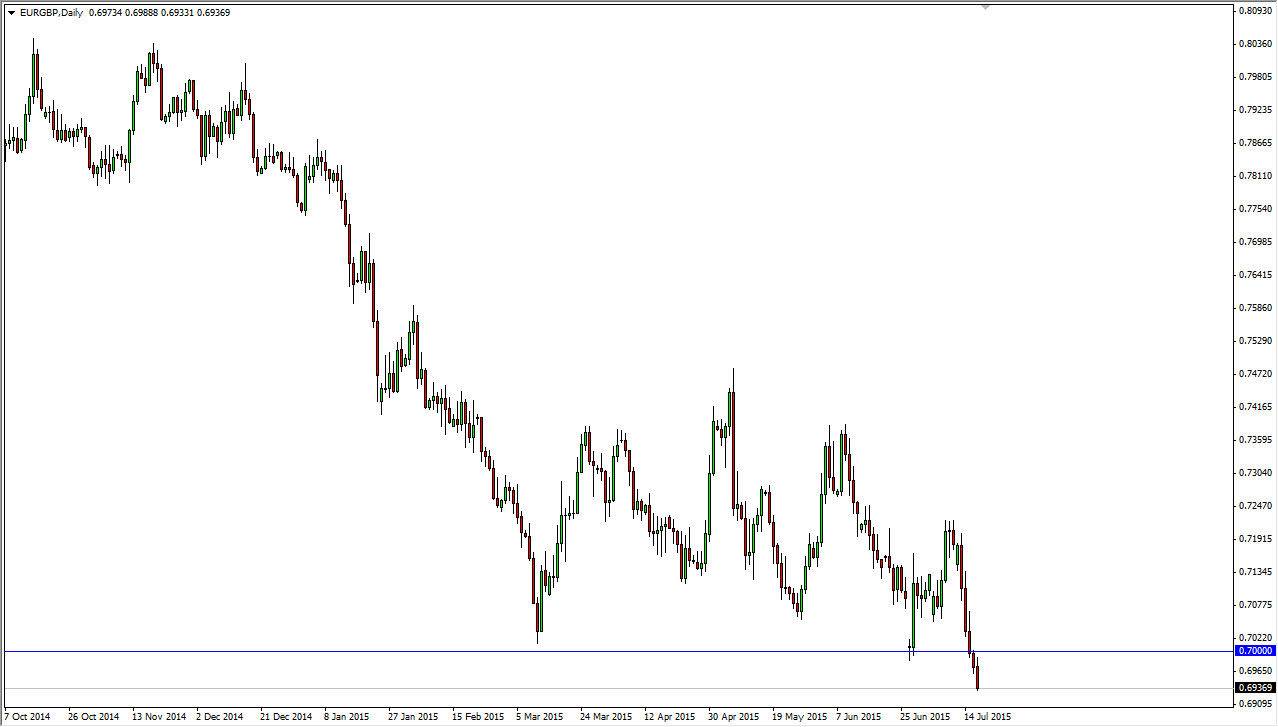

The EUR/GBP pair initially tried to rally during the course of the day on Friday, but as you can see the 0.70 level above was once massive support, so it should now be resistance. With that being said, I look at the longer-term charts and see that there is a cluster of support all the way down to the 0.66 handle. When you get a move like this, typically the market needs to test the bottom of the support, so I believe that this market is heading down to the 0.66 handle given enough time.

Ultimately, I think that will be a noisy move down to that level but it does make sense as the Euro simply is not trusted at the moment, and the British pound at least is making some noise to the upside. After all, the GBP/USD pair is showing signs of support and upward momentum, which of course would be the measuring stick of British pound strength in general. On the other hand, you have the EUR/USD pair which looks like it’s ready to continue falling. In other words, I think that the Euro weakness continues.

So exactly what happened?

It looks as if that’s the question the markets are asking. The Greeks got another bailout, but how long as it’s going to last? Truthfully, it’s very likely that more will need to be done in the future, and I think that this chart reflects that. Money from the continent is heading to London, as people look to protect their wealth. On top of that, you would have to think that British strength in general isn’t exactly hurting this move either.

I think that selling rallies going forward will be the way to go going towards the end of the year as I would anticipate getting to 0.66 somewhere in the next couple of months. Remember, this is a pair that has a larger PIP value, see you don’t need it to move as much. I believe in selling and selling again.