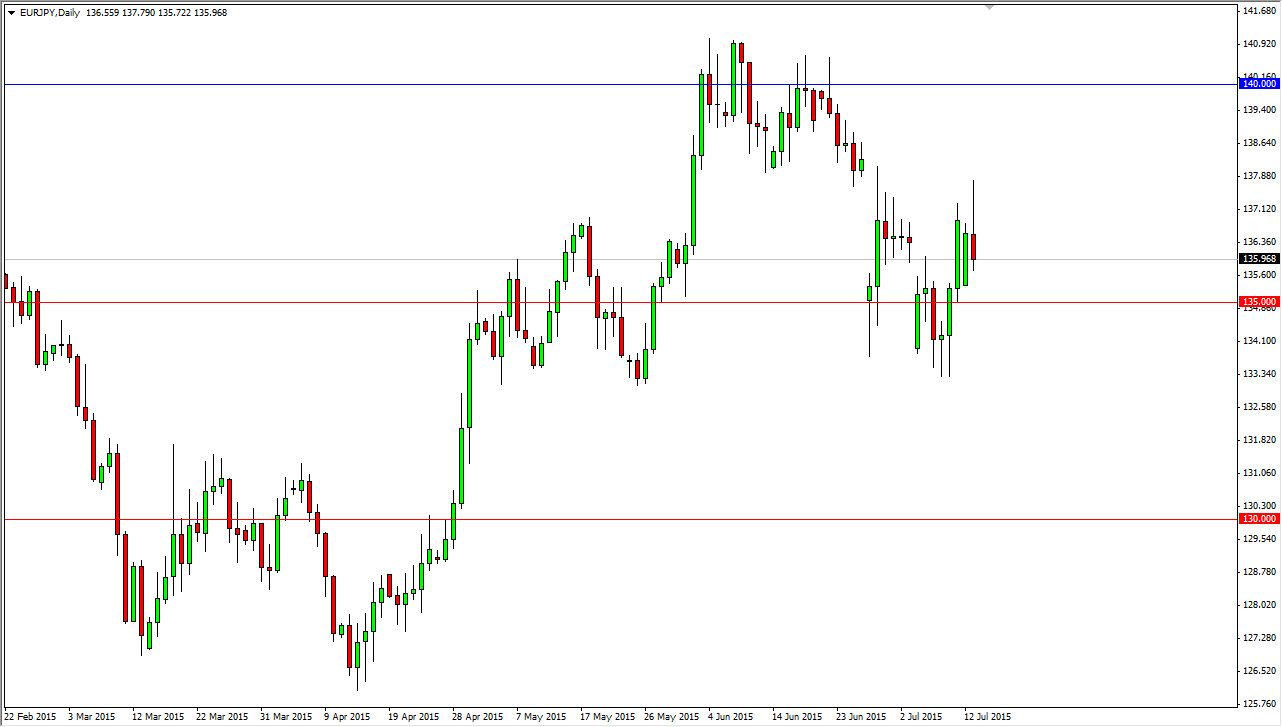

The EUR/JPY pair initially rallied after we got wind that the Greeks and the Europeans seem to be getting close to an agreement. The Euro in general rallied which you would expect, but ultimately the market sold off the Euro as there seems to be quite a bit of doubt surrounding the currency in general. With this, it makes sense that people would buying the Japanese yen, simply because it is considered to be one of the more safe currencies out there. When you are worried about the volatility and the viability of a common currency in general, it makes sense that you would go as far away from it as you can, and buying the currency of the country that is considered to be much more stable.

This flies in the face of the Bank of Japan, which of course is trying to bring down the value of the Japanese yen in general. With that, I feel that it is only a matter of time before this market bounces again, but in the meantime it looks like we are heading back to the bottom of the most recent consolidation area.

Reaching for 134

I believe it will head back down to the 134 level, which is the bottom of the most recent consolidation area. With that, I feel that the market finds quite a bit of support down there, and we just simply bounce from there in order to continue doing what we have been doing. With that, the markets will be a short-term sell, followed by a short-term buy. I believe that we will stay in this range but there’s probably more of an upward bias over the longer term as the Japanese will eventually get the move that they have been waiting for. Granted, the Euro will continue to have its issues, but at the end of the day I feel that the central bankers will get what they want in Tokyo.