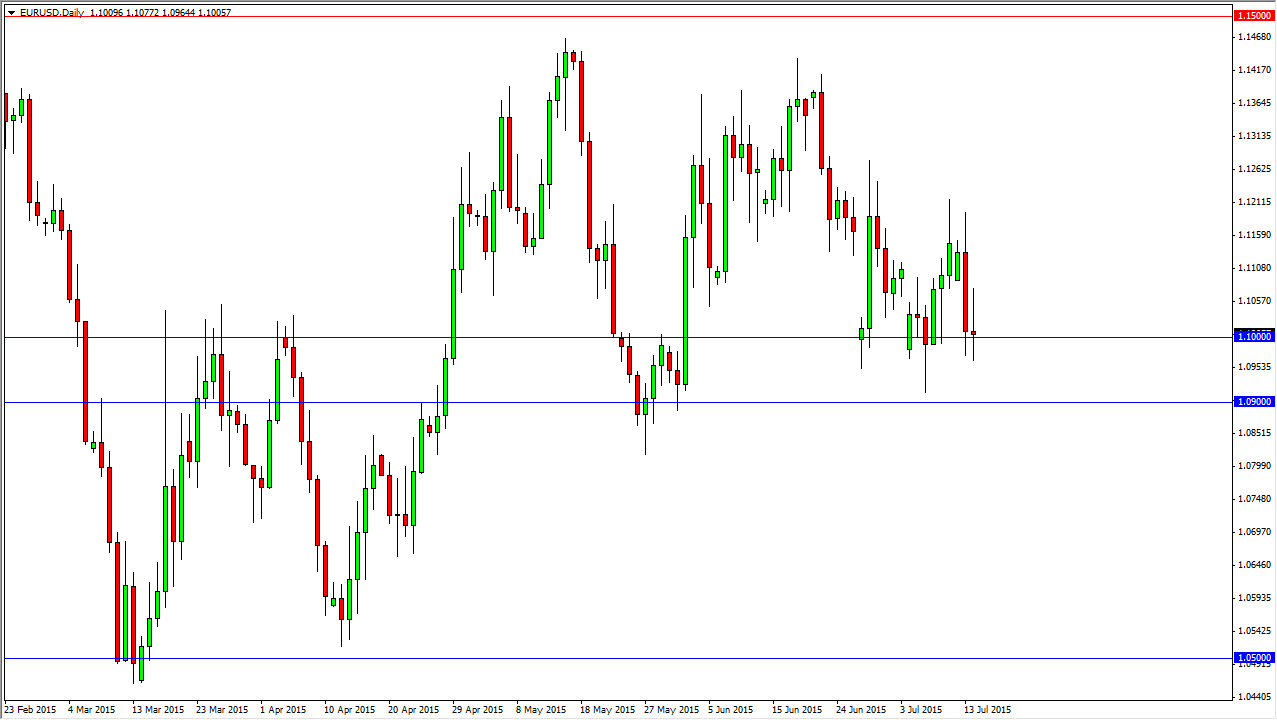

The EUR/USD pair had a pretty volatile session during the course of the day on Tuesday, as the market simply could not figure out what it wanted to do. With that being the case, I believe that this market continues to show support below the 1.10 level, with the 1.09 level below being the bottom of that support region. With that being the case, the market looks as if they’re going to be plenty of buyers in this general vicinity. With that being the case, the market looks like the buyers are at least keeping this market somewhat stable, and as a result I believe that short-term trading is about the only thing that you will get. Because looking at this market, I can see that there is a significant amount of resistance above as well. I think that the 1.12 level above is resistive as well, so having said that, I believe that most of the trades that you will be involved in will probably be measured in hours, not days.

Now what?

Now that the Greeks are agreeing to the creditor’s terms, it appears that the markets will calm down. But we are also in the middle of this summer, and that of course suggests that we might get little in the way of true movement. With that being the case, I think that we have a perfect example of a trading condition that keeps this market fairly quiet. That doesn’t mean that we couldn’t have a move, but I also believe that no matter what happens, we will see quite a bit of volatility.

I think that it’s only a matter of time before we see more consolidation, but at this moment I believe that a lot of people are simply catching their breath after all of the volatility in the news. That being the case, I think that it’s only a matter of time before we simply go back and forth. I think that a lot of the market participants are now starting to wonder what the viability of the Euro will be, as we have certainly seen how difficult keeping this whole thing together could be. I believe we continue to bounce around between the 1.10 level and the 1.12 level.