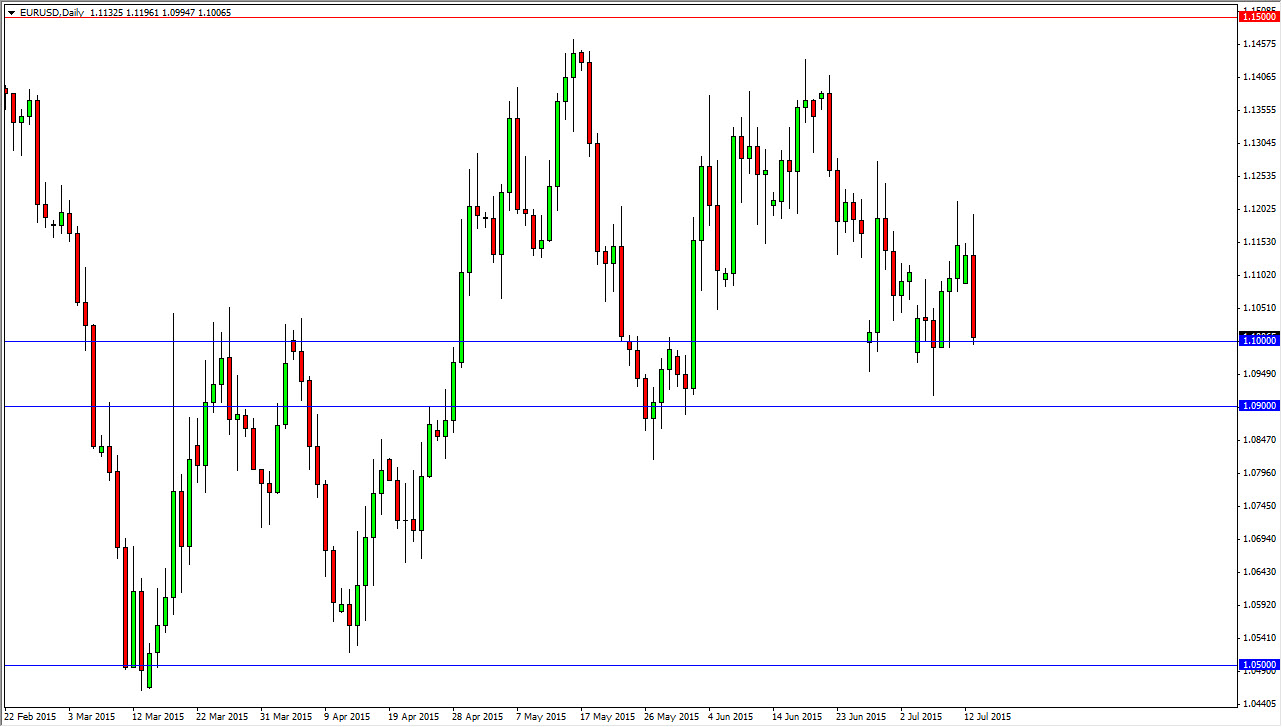

The EUR/USD pair initially tried to rally during the session on Monday as we got word that the Greeks are more than likely going to pass the measure to accept austerity. However, the markets seem to have given a bit of a “thumbs down” to the outcome, as the EUR/USD pair fell during the course of the session eventually. In fact, we ended up falling all the way down to the 1.10 level, an area that is very supportive, and in my opinion is the beginning of massive support all the way down to the 1.09 handle. With that, I am waiting for some type of supportive candle or a simple bounce in order to start buying the Euro again.

However, there is the possibility we break down…

The 1.09 level is essentially the “switch” as far as the directionality on how I am going to trade this pair. If we break down below the 1.09 level, I think at that point in time will probably head down to the 1.05 handle. That area should be massively supportive as well, and this would just be a simple return to the overall consolidation that we have seen in this market for the last several months.

However, I believe that the volatility is going to be strong regardless of what we are going and which direction we are going. I think that there are some real weaknesses in the whole idea of the monetary union that have been exposed because of this Greek situation, and with that it’s probably only a matter of time before the Euro get sold off again even if we break higher. Don’t get me wrong, I believe that this market will bounce to go much higher for quite some time, but if you look at the longer-term monthly charts, we are in a massive downtrend over the last several years, which has seen this market fall, bounce high, and then fall again. However, when you look at the monthly charts, the highs are definitely getting lower. I think that we will see a significant bounce sooner or later, but we will revisit this type of trading again.