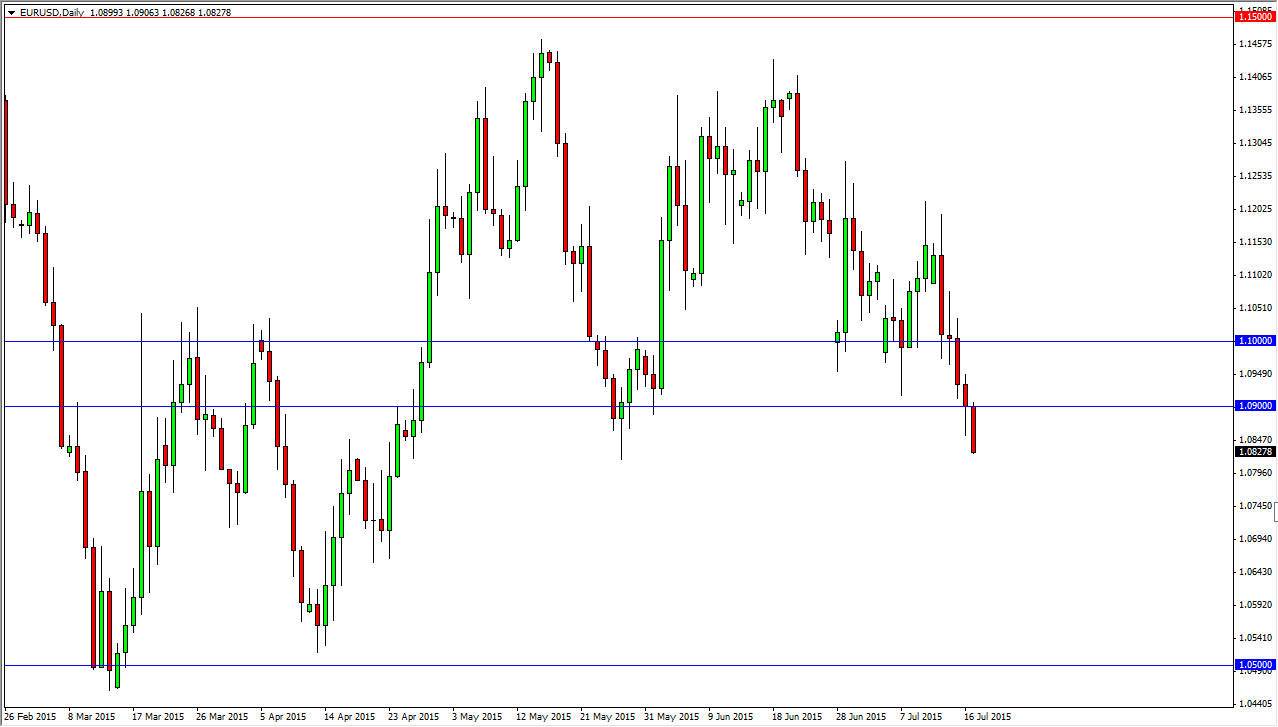

The EUR/USD pair broke down during the session on Friday, clearing the bottom of the hammer that formed on Thursday. Because of this, I feel that this market is ready to continue breaking down now, and it’s probably only a matter of time before we try to reach the 1.05 level. However, that’s not to say that this is going to be a sudden and impulsive move. It’s quite likely that we are going to have bounces from time to time, and it looks like as per usual, the EUR/USD pair is probably going to be a short-term trader’s type of market.

Quite frankly, there’s a lot of reasons for this in my opinion, not the least of which would be the advantage of high-frequency trading in the Forex markets. Naturally the EUR/USD pair is where they are attracted to first, because the spread that large brokers with ECN type floats can be nothing at times. Furthermore, there are the obvious economic situations to pay attention to.

Perhaps Greece didn’t impress

The fact that we have a Greek debt deal in place really isn’t what the markets seem to be paying attention to anymore. Quite frankly, I believe they have simply kicked the can down the road yet again, and we will revisit this problem again and again until somebody truly does something drastic. I think that a lot of traders out there are starting to wonder if the European Union can hold together, as the monetary policy one country has to be drastically different than another for economic viability to be the norm.

Questions of whether or not Spain, Italy, and Greece should be lumped in with countries like the Netherlands, Germany, and France certainly are being asked right now. With that, there isn’t a lot of confidence in the common currency, but at the end of the day I don’t expect some type of meltdown. I think that we’re going to see a general malaise in this market, essentially leading to back and forth trading in the recent consolidation area. This is why I think the 1.05 level will probably hold. The best way to trade this pair in my opinion is to simply sell short-term rallies for small moves.