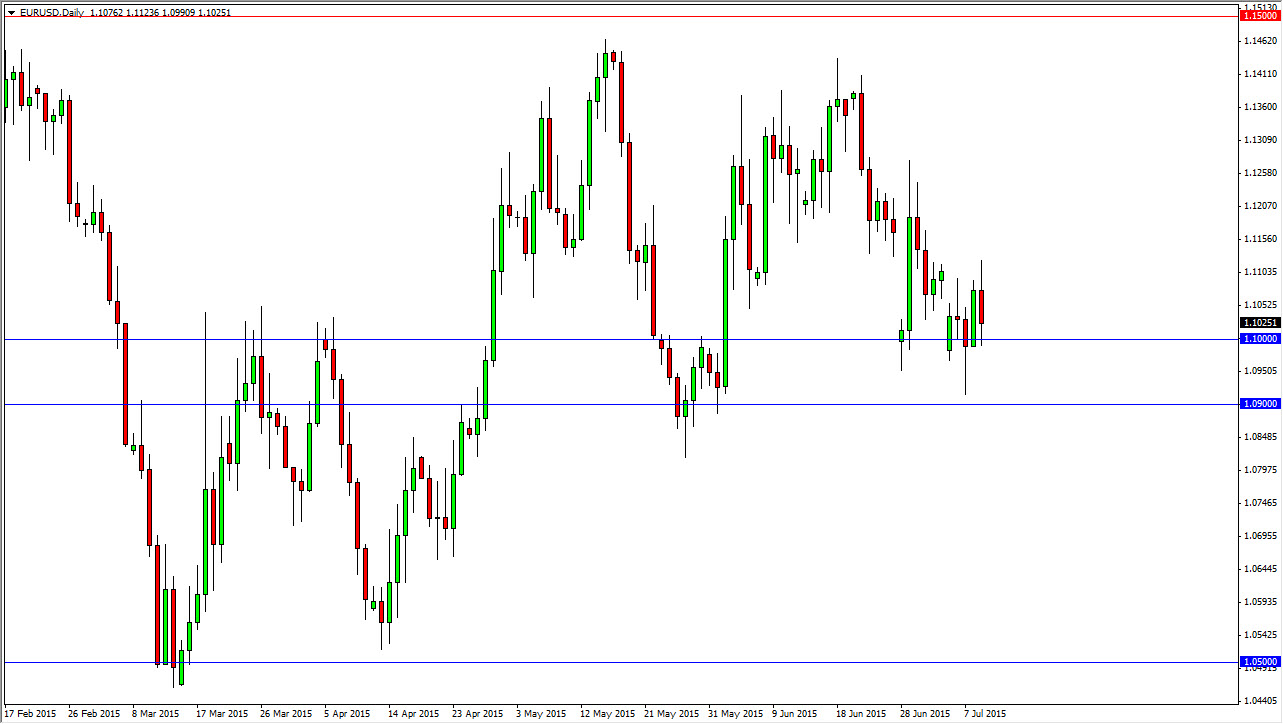

The EUR/USD pair initially tried to rally during the session on Thursday, and then fell rather hard into the 1.10 handle. This is an area that has been supportive in the past, so quite frankly it’s not a big surprise to imagine that the buyers stepped back into the marketplace as the area has been so reliable recently. With that, I believe that we are going to see yet another bounce and as a result I am bullish of this market for the short-term. With that, I already put a small position on to continue to play the short-term volatility, as the market simply looks ready to go back and forth at the moment. Keep in mind that until we get some type of solution to the Greek crisis, it’s probably going to be asking quite a bit for the market to make any longer-term moves.

Keep position size small

I believe that you’re going to have to keep the position size small in this market, as the volatility will certainly be immense. Because of this, I am trading half the size that I normally would, and as a result the markets will probably continue to be very difficult. However, I think that there is a significant amount of support below, as the support is essentially a “zone” that extends all the way down to the 1.09 handle. It is not until we break significantly below that level that I would consider selling at this point in time.

I believe that we will probably head back to the 1.1150 region, which of course was resistive. If we can get some type solution to the Greek crisis, you can anticipate that the EUR/USD pair will probably head all the way to the 1.14 level next. Ultimately, I think that we are going higher based upon the fact that support has held, but with it being summertime, you cannot expect too much in the way of a large move. Ultimately, I think this choppy behavior is what we will have for the next several sessions.