EUR/USD Signal Update

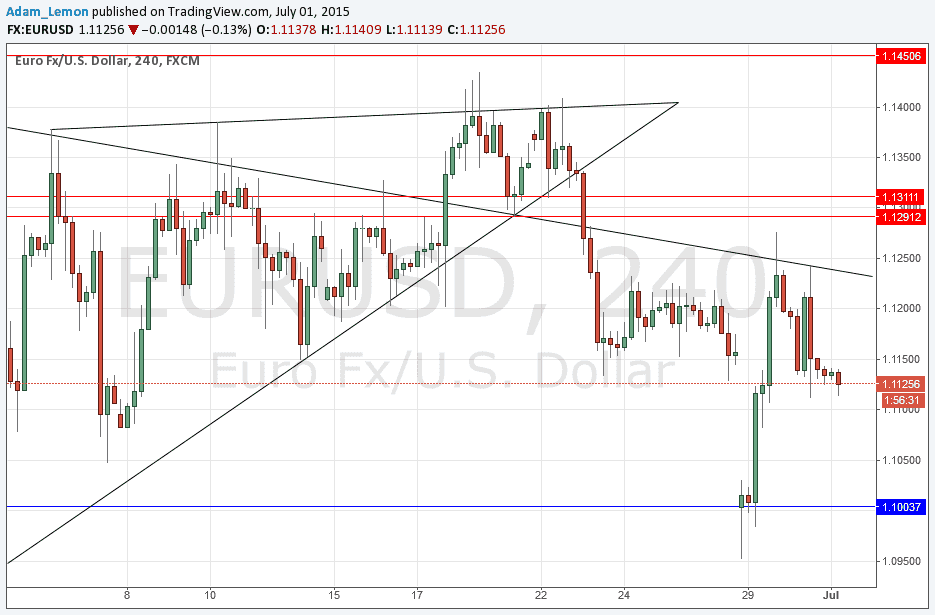

Yesterday’s signals could have given a successful long trade as the support at 1.1134 was the low of the day practically to the pip. The bearish trend line later prove to be solid resistance, providing the high of the day.

Today’s EUR/USD Signals

Risk 0.75%

Trades may only be taken between 8am and 5pm London time today.

Short Trade 1

Short entry following a bearish price action reversal on the H1 time frame immediately upon the next touch of the bearish trend line currently sitting at around 1.1238.

Place the stop loss 1 pip above the local swing high.

Move the stop loss to break even once the trade is 20 pips in profit.

Remove 50% of the position as profit when the trade is 20 pips in profit and leave the remainder of the position to ride.

Short Trade 2

Short entry following a bearish price action reversal on the H1 time frame immediately upon the next entry into the zone between 1.1291 and 1.1311.

Place the stop loss 1 pip above the local swing high.

Move the stop loss to break even once the trade is 20 pips in profit.

Remove 50% of the position as profit when the trade is 20 pips in profit and leave the remainder of the position to ride.

Long Trade 1

Long entry following a bullish price action reversal on the H1 time frame immediately upon the next touch of 1.1003.

Place the stop loss 1 pip below the local swing low.

Move the stop loss to break even once the trade is 20 pips in profit.

Remove 50% of the position as profit when the trade is 20 pips in profit and leave the remainder of the position to ride.

EUR/USD Analysis

Despite all the ongoing Greek drama, the market was relatively restrained yesterday, with volatility not really any greater than usual, and with technical boundaries respected perfectly at 1.1240 and 1.1134.

We have been chipping away at the previous support at 1.1134 and so it does not look very reliable any more. With this, if the price breaks down below the round number at 1.1100, it could continue to fall all the way to 1.1000 or thereabouts.

Of course, there may be an announcement of some kind of Greek deal later today, which could cause the price to go shooting off anywhere, so be careful.

There are no special items scheduled for the EUR today, although the Greek crisis in ongoing and highly relevant in this market. Concerning the USD, there will be ADP Non-Farm Employment Change data at 1:15pm London time followed later by ISM Manufacturing PMI data at 3pm.