EUR/USD Signal Update

Yesterday’s signals expired without being triggered.

Today’s EUR/USD Signals

Risk 0.75%

Trades must be entered before 5pm London time today.

Make sure the risk on any open trade is taken off before 1pm London time.

Short Trade 1

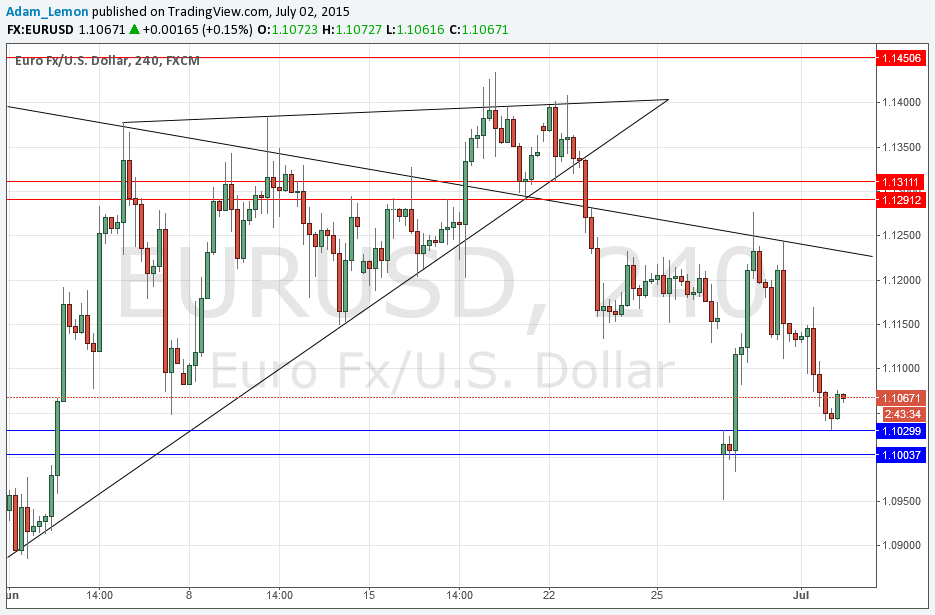

Go short following a bearish price action reversal on the H1 time frame immediately upon the next touch of the bearish trend line currently sitting at around 1.1226.

Put the stop loss 1 pip above the local swing high.

Adjust the stop loss to break even once the trade is 20 pips in profit.

Take off 50% of the position as profit when the trade is 20 pips in profit and leave the remainder of the position to run.

Long Trade 1

Go long following a bullish price action reversal on the H1 time frame immediately upon the next touch of 1.1030.

Put the stop loss 1 pip below the local swing low.

Adjust the stop loss to break even once the trade is 20 pips in profit.

Take off 50% of the position as profit when the trade is 20 pips in profit and leave the remainder of the position to run.

Long Trade 2

Go long following a bullish price action reversal on the H1 time frame immediately upon the next touch of 1.1003.

Put the stop loss 1 pip below the local swing low.

Adjust the stop loss to break even once the trade is 20 pips in profit.

Take off 50% of the position as profit when the trade is 20 pips in profit and leave the remainder of the position to run.

EUR/USD Analysis

Yesterday this pair fell, finding a bottom at 1.1030 which acted as resistance early during Monday’s trading, so this looks to be a flipped level that could well be supportive if we return there.

The market of course continues to be dominated by the very confusing and dramatic Greek crisis. However it looks like there may be a period of relative quiet on that front until the weekend. However later today we have the NFP which can have a big impact on the USD, so news rather than technical could well be the key driver.

As well as the levels mentioned above, it seems that the area around 1.1150 could also provide some resistance.

Concerning the USD, there will be Non-Farm Employment Change and Unemployment Change data at 1:30pm London time, one day earlier than usual. Regarding the EUR, the President of the ECB will be speaking at 4:10pm, but is unlikely to be anything of importance.