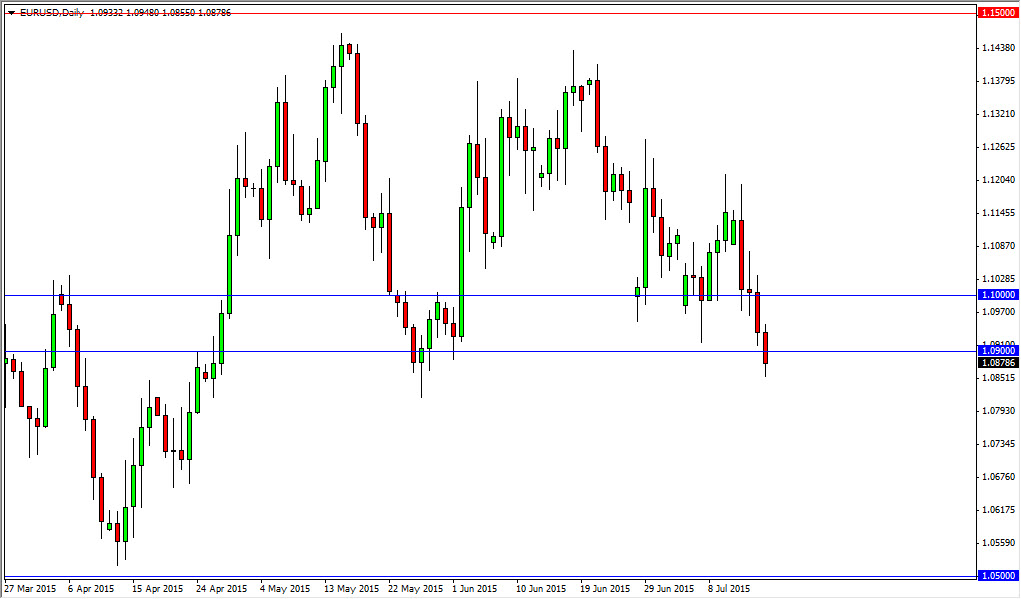

Looking at the EUR/USD pair, one of the first things I notice is that we did in fact break down below the 1.09 level. Because of this, I feel that we are probably going to continue to go lower but I do not expect an easy move below here. After all, there is a hammer to contend with from the beginning of May which of course will have an effect as far as support is concerned, and of course there are a lot of headlines out there that could move this market. With that being said though, I cannot help but notice that the Euro is struggling in general. With fact, I think that the Euro will continue to sell off against multiple currencies, not just the US dollar. However, if the keep in mind that the EUR/USD pair is essentially the “measuring stick” of Euro strength, and as a result as this pair goes typically most EUR/XXX pairs go.

Lots of confusion

I believe that there are still lots of confusion out there due to what happened in Greece, and the fact that longer-term thinkers probably realize that there has not been a complete solution realized. With that, I feel that it’s only a matter of time before the Euro struggles again, but what I find interesting is that it seems to be falling right away. This is a very interesting development, as is a bit counterintuitive. After all, you wouldn’t be alone in believing that kicking the can down the road in Greece should have been good for the value the Euro. However, we find yourselves in a situation where perhaps the markets are finally realizing that the situation in Greece only exposes many of the problems with the European Union in general. It’s much akin to trying to make what is a diverse continent become one financial union. With put it this way: could you imagine the United States, Haiti, Mexico, and Nicaragua all forming the same monetary union? It wouldn’t work either. With that being said, I am a seller on a break below the bottom of the range for the day, but quite frankly will more than likely short the Euro against other currencies.