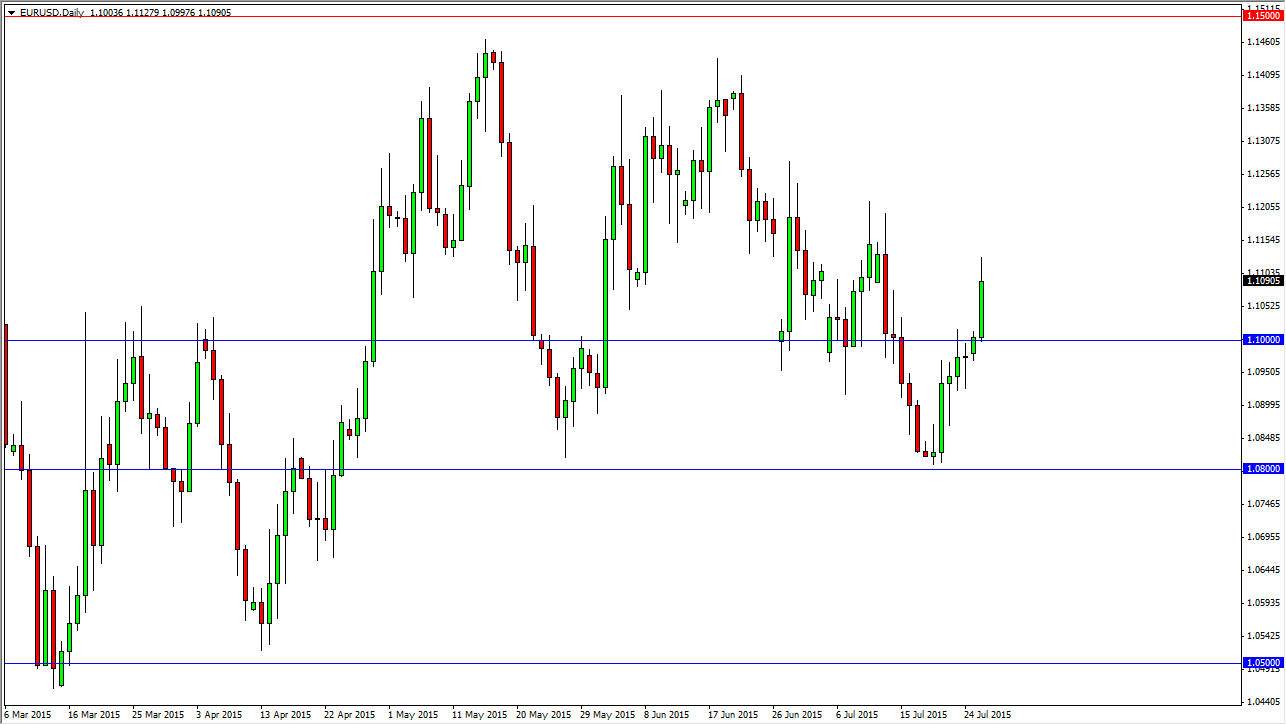

The EUR/USD pair took off to the upside during the session on Monday, easily hurtling over the 1.10 handle. This of course is a very bullish sign, as we went towards the 1.11 handle. We of course did find a bit of resistance there, but at the end of the day it’s only a matter of time before the buyers step back into this market. The 1.10 level is of course a large, round, psychologically significant number, so the fact that we broke above there does in fact attract a lot of attention.

Having said that, I believe that we are now going to head to the next significant resistance barrier, the 1.12 handle. Even though we sold off towards the end of the day on Monday, and near the 1.11 handle, I believe this simply will offer buying opportunities on short-term charts. After all, the Greece drama is “fixed”, right?

Choppiness

This market will continue to show quite a bit of choppiness, considering that we are in the middle the summer time that would be somewhat normal. However, there is still a lot of down when it comes to what happened with the Greek debt situation, and the reality is that we will revisit this issue yet again. With this, I would anticipate that it’s only a matter of time before we sell off again, but in the short-term it does appear to me that we are going to try to reach the aforementioned 1.12 handle. I would stick to short-term charts, because quite frankly you cannot be married to any position in this market right now. We are simply far too choppy at the moment, and as a result if you try to hang onto a trade for any real length of time, it is going to be very difficult and probably shake you out of the marketplace. In fact, I believe that’s the way this market will remain until late August.