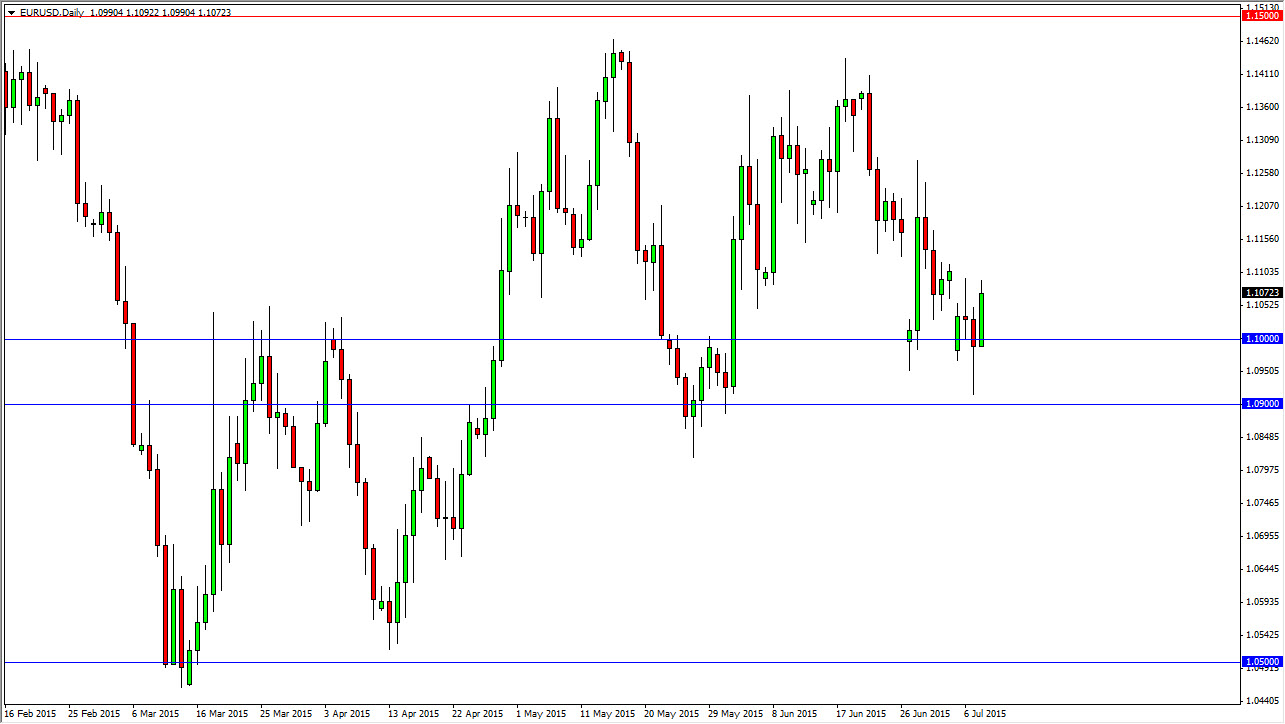

The EUR/USD pair broke higher during the course of the day on Wednesday, as we broke above the top of the hammer from Tuesday. We also filled the gap yet again, and as a result it looks as if the EUR/USD pair is going to continue to go higher given enough time. Quite frankly, I think that the markets are starting to get a bit tired of the Greek debt issue, and the gains that the Greeks and bankers are playing with each other. Ultimately, the Euro has nowhere to go but higher.

The reason I say this is that if the Greeks figure out some type of agreement with the European Union that will be positive. The other hand, the Greeks could leave the European Union, and longer-term that will be positive as well, as we will have essentially cut the cancer from the body.

Buying pullbacks

I believe as long as we stay above the 1.09 level, it’s probably prudent to buy pullbacks as they occur. Quite frankly, I think that we will continue to consolidate between the 1.09 level and the 1.44 level for the rest of the summer. I believe that there is an upward bias, and I also believe that the longer term “smart money” has been buying Euros for some time now. I believe that those out there who can hang onto the currency trade for long periods of time recognize that the Euro is essentially “cheap”, and as a result they are willing to purchase them as they pullback. Ultimately, Forex pairs tend to change trends every 2 or 3 years, and as a result it looks like we are simply going to yet another cycle.

I’m not suggesting that there won't be a lot of volatility, of course there will be. However, if you find yourselves in a situation that allows you to hang onto a longer-term trade, this is essentially the mother of all trend reversals at the moment, and I believe that the Euro will continue to go higher over the longer term. I am bullish, but recognize that it will be a tough fight.