Gold prices remain coiled within the recent trading range during today's Asian session as the Federal Reserve meeting gave investors few new clues as to when interest rates may rise. The markets were looking for some more specifics in terms of timing but policy makers didn't hint of a September policy move - they didn't rule out either. In a statement after its two-day meeting, the Federal Open Market Committee said "The Committee anticipates that it will be appropriate to raise the target range for the federal funds rate when it has seen some further improvement in the labor market and is reasonably confident that inflation will move back to its 2 percent objective over the medium term".

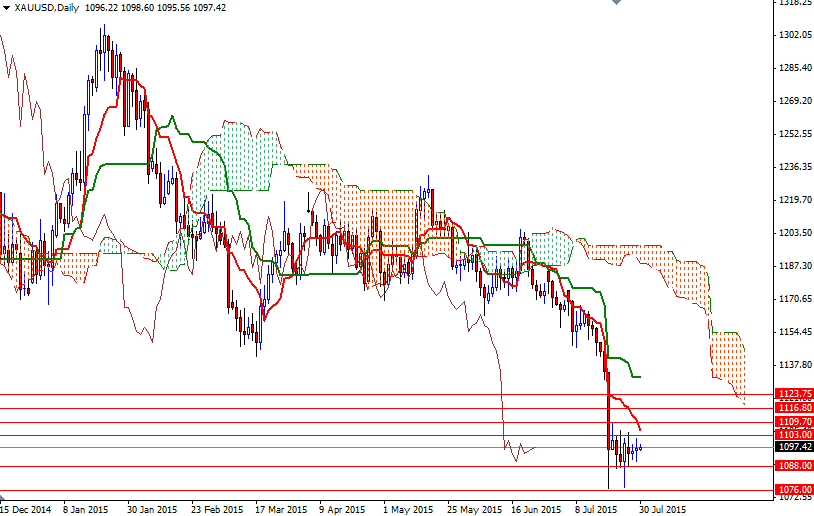

Attention now turns to the first estimate of second-quarter U.S. gross domestic product figures due later today. We have seen pretty much sideways action in gold recently, especially since the dramatic slide last Monday, but we are going to break out of this tight range eventually. While the trend is rather bearish in the big picture, there is the possibility of a short-term upswing if we break through 1105/3.

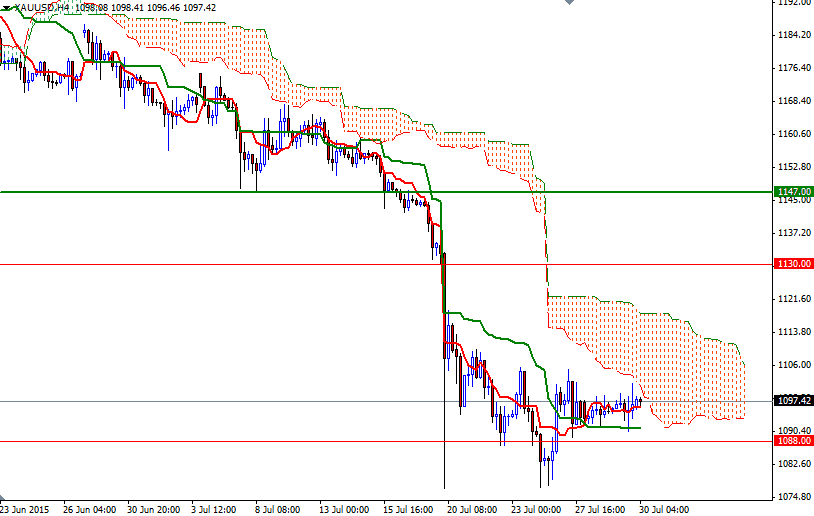

However, as you can see on the 4-hour chart, the Ichimoku clouds stand right on top us and occupy a large area which is supposed to act as resistance. The bulls will need to capture the 1109.70 level so that they can find a chance to test the 1116.80 resistance. To the downside, I will be keeping an eye on the 1088/6 area. If this support fails to hold the market, then increasing selling pressure could drag XAU/USD towards the 1076/1 region. Closing below this critical support would puts us back on track with such a scenario eying subsequent targets at 1062.85 and 1045.