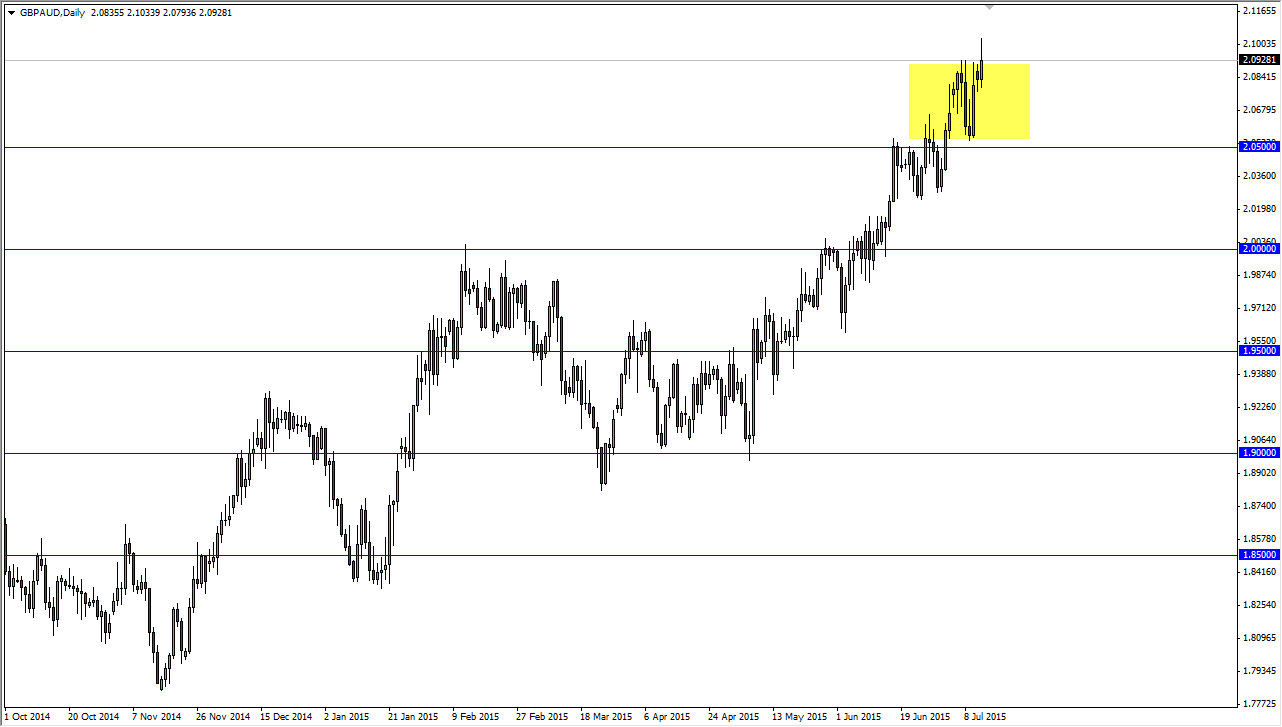

The GBP/AUD pair broke out during the course of the session on Monday, but as you can see pulled back to form a shooting star. This isn’t much of a surprise to me though, because the 2.10 level is of course a large, round, psychologically significant number. Because of this, it’s very likely that a lot of profit taking occurred. On top of that, you have to keep in mind that the British pound pullback in general later in the day, so as a result it doesn’t really surprise at all that we follow.

With this, I believe that we could find yourselves reach back towards the 2.05 level which of course is the bottom of the recent consolidation area, meaning that we have a short-term selling opportunity, but more importantly we have a long-term buying opportunity at lower levels. This pair is obviously in an uptrend, and there’s no point in fighting it at this point in time.

British pound strength, Australian dollar weakness

The British pound in general is strong against most currencies, while the Australian dollar is rather weak. So because of this it makes perfect sense we continue to go higher. I look at pullbacks as simply an opportunity to find “value” in the Pound, and as a result I am much more apt to buy this market on the pullback then sell the short-term opportunity that could present itself on a break below the bottom the shooting star.

I believe that the market needs to find a bit of footing below in order to build up enough momentum to finally break above the psychologically significant 2.10 level. I do think that it will happen sooner or later, so at this point time is a certain amount of back and forth in the short-term in order to convince traders are they can go much higher. Ultimately, a lot of this comes down to having enough momentum to continue. I think that’s essentially what we will be working on over the course of the next couple of sessions.