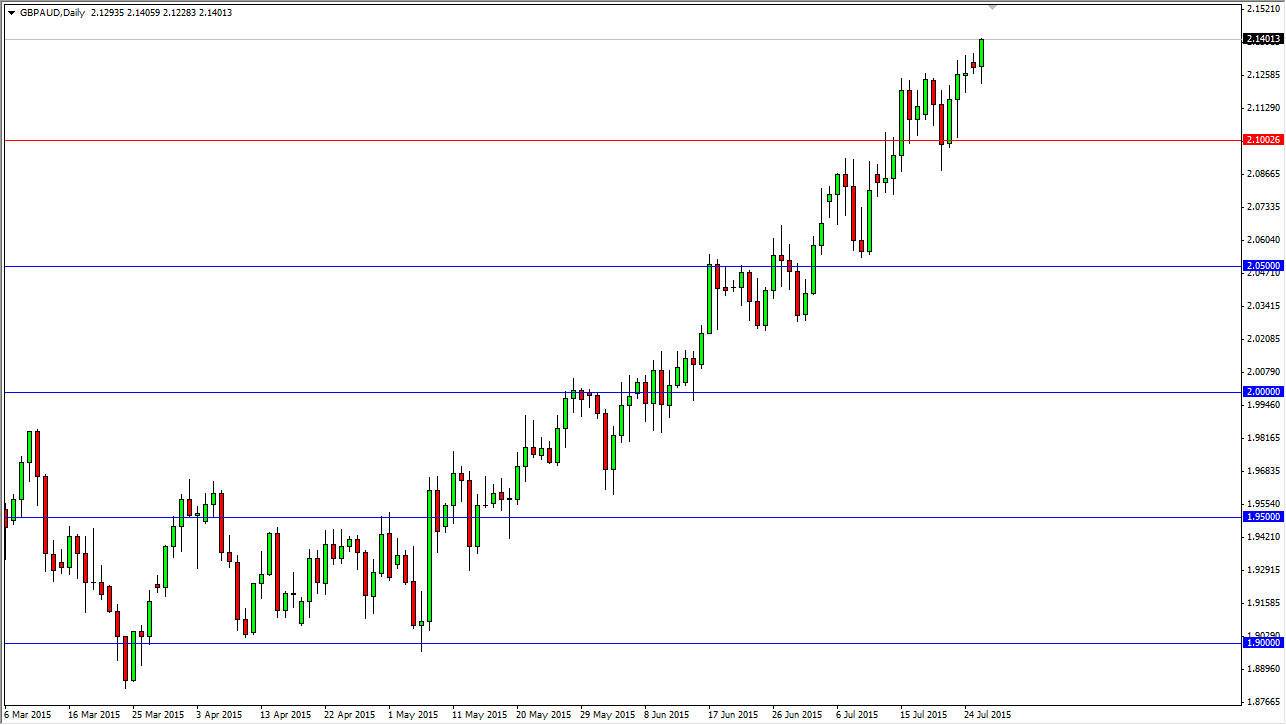

The GBP/AUD pair initially fell during the course of the day on Monday, but found enough support below the 2.1250 level to turn things back around and close the very top of the range. This of course is a very bullish sign, and continues to suggest that the Australian dollar is far from being bullish anytime soon. With this, I believe that this market is an excellent opportunity to “buy on the dips” as we go forward. After all, the British pound has been holding its own against the US dollar, while the Australian dollar of course has been sold off rather drastically against most other currencies around the world.

On top of that, obviously the Australian dollar is highly leveraged to the Asian economies, which of course look to be slowing down. With this, I believe that Australia continues to suffer, and that we could possibly even see some type of rate cut in the near future. With this, it’s very likely that the Australian dollar continues to find sellers every time it tries to rally.

Gold markets

Gold markets are of course not helping at all. After all, the Australian dollar is highly sensitive to the gold markets, and they are absolutely falling apart. I think it’s only a matter of time before we find support in gold, but there is a significant distance to go before we reach what I think could be where the buyers step back in. Having said that, in the meantime I believe that the Australian dollar continues to fall against everything. That’s not to say that it won’t end, just that one school gets to that level - $1000 - we might have to be a little bit more selective about how we choose to sell the Australian dollar. Having said that, I believe that this pair might be one that continues to simply grind higher because it is a long time before the Australians catch up with what we may have in the United Kingdom as far as economic growth.