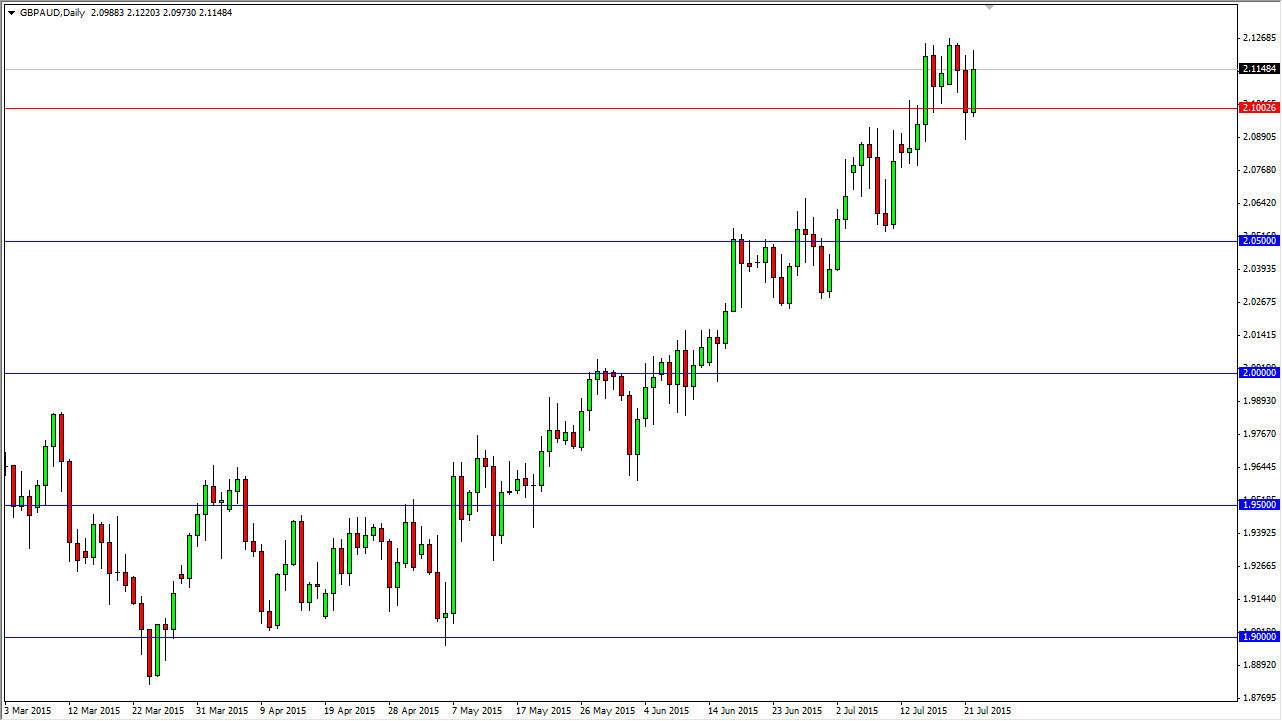

The GBP/AUD pair bounced during the session on Wednesday, using the 2.10 level as support. With this, it looks like the market is ready to continue going higher given enough time, and I believe that the pair will target the 2.1250 level yet again. However, I believe that the longer-term trend is very much in effect, and we should continue to go much higher given enough time. I think that buying on short-term pullbacks will be the way going forward. I do expect to see a fair amount of volatility, but quite frankly the Australian dollar is very soft at the moment, and of course with gold markets showing such weakness it isn’t exactly a good sign for the Aussie either.

I think that if we can continue the grind higher, we should eventually reach towards the 2.15 handle, which of course is the next large, round, psychologically significant number. Markets tend to move in even handles given enough time, and this pair of course will be any different.

British pound strength

Don’t forget that there is a certain amount of British pound strength anyway, so it makes sense of this pair continues to go higher. After all, you are simply measuring the relative strength between both of these currencies, and right now the British pound is probably the strongest currency that I follow with the exception of the US dollar. With that, it makes sense that the Australian dollar which seems to be struggling so much, would of course drop in value against the British pound overall.

Technically speaking, the 2.10 level was significant resistance previously, and it should now be support. By all means, it does look like it’s going to be the case, and with that I remain very bullish of this pair. In fact, I believe that the gold markets are going to drop down to the 1000 handle, and that should do a bit of a number on the Australian dollar going forward. I remain bullish.