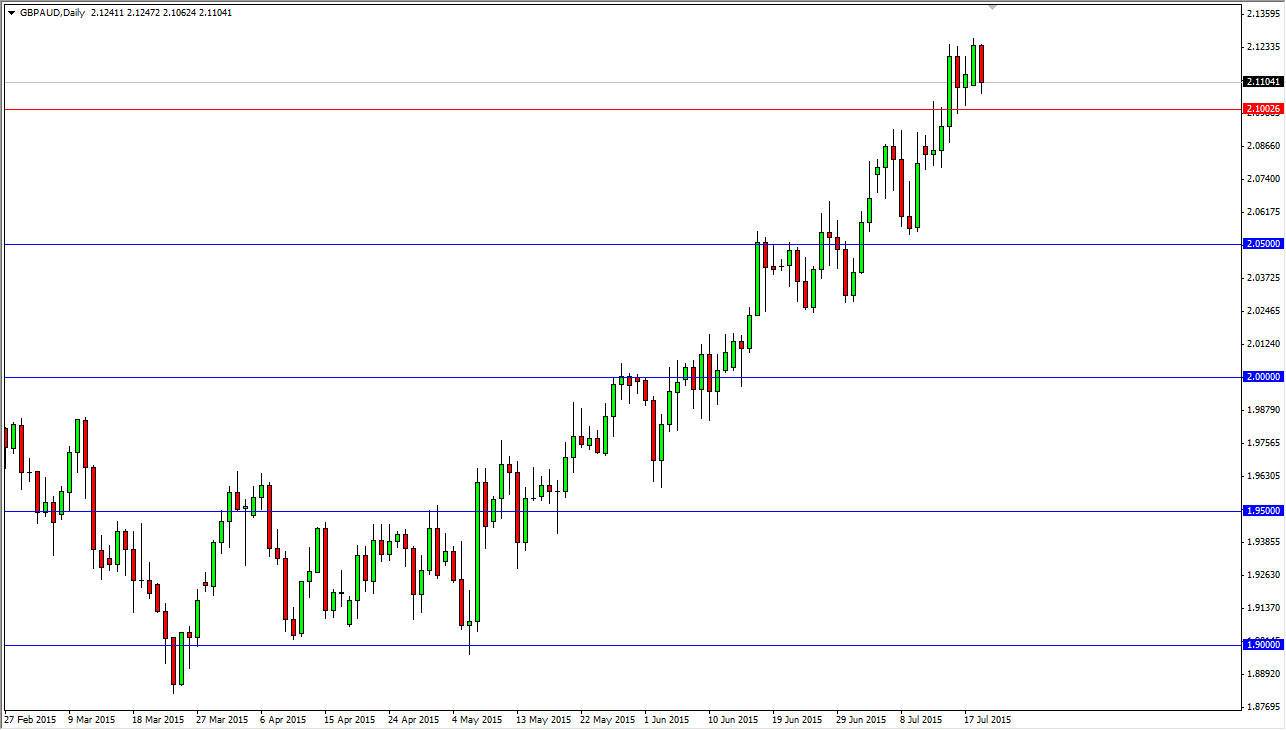

The GBP/AUD pair pulled back during the session on Monday, as we continue to look for buying pressure just above the 1.10 handle. With this, it’s only a matter of time before the market finds buyers, and perhaps goes as high as the 1.12 level above. In fact, I believe that we are going to go much higher than that, and as a result my real target is probably 2.15, given enough time.

The Australian dollar is of course very soft at the moment, and while the British pound had a fairly slow session, the reality is that a lot of the fundamental drivers for the Australian dollar do not look good at the moment. After all, gold is absolutely falling apart at the moment.

2.10 should be the “floor” at the moment

I think that in the short-term, the 2.10 level should be supportive as it was once massively resistive. Now that we have broken above that resistance, it makes sense that we should find support. Ultimately, I believe that every time we pullback, it’s probably going to be a buying opportunity. Because of this, I think that a lot of short-term traders are going to be involved, simply going long for short periods of time. The short periods of time can offer back and forth type of trading, as ultimately we will go higher.

I think it’s only a matter time before you higher, but I do recognize that we could have a lot of volatility is the gold markets looks set to cause a lot of problems. With this, I think as long as gold looks soft, this pair should go higher. However, if we get some type of massive bounce in the gold markets as a reaction, we could get stopped out of long positions in this particular pair. With that, I am cautiously optimistic but aware of the underlying volatility in the commodity markets.