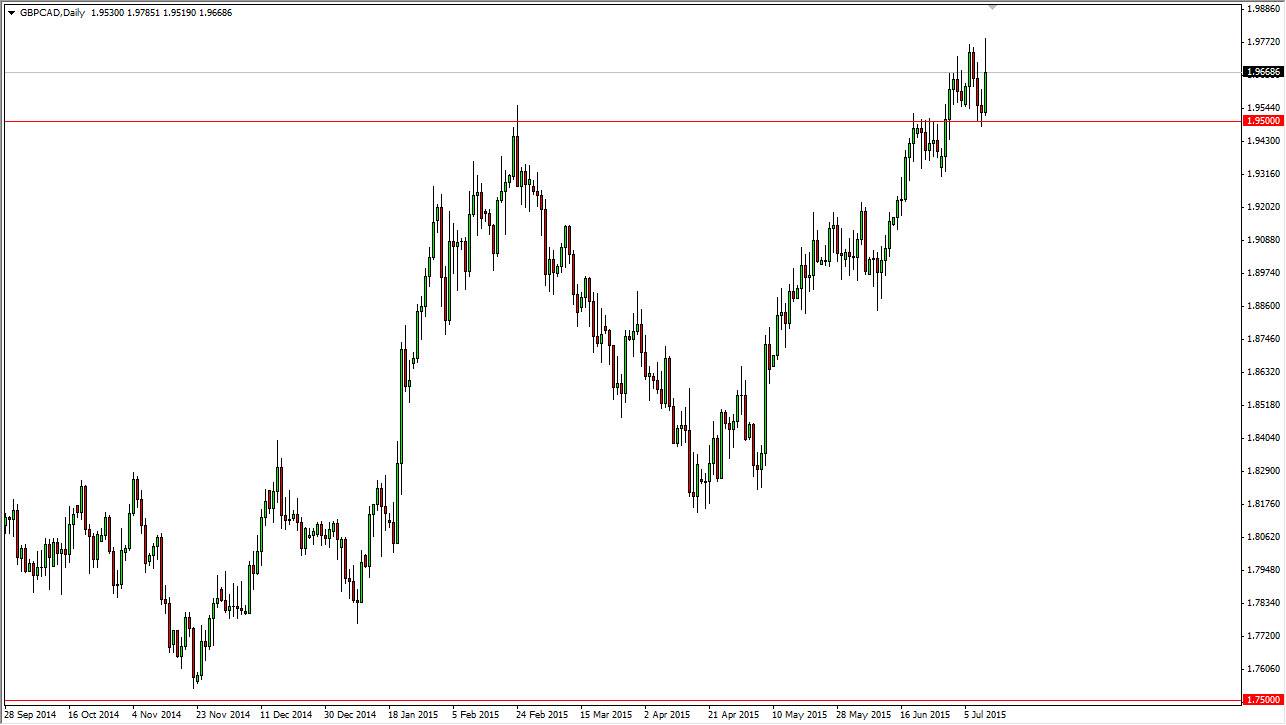

The GBP/CAD pair broke higher during the course of the session on Friday, using the 1.95 level as massive support. Because of this, looks like the market is ready to continue to go higher given enough time, but we did get back some of the gains, perhaps in a little bit of profit taking before the weekend. This is a decent pair to take into account instead of some of the ones that will be driven by the Greek debt crisis, as we have a nice uptrend, and have broken above pretty significant resistance recently.

It appears that the market is going to continue to find buyers going forward as we reach towards the 1.95 level, but we will more than likely just bounce around in the short-term. I think that the 1.98 level above is resistance, but more than likely at this point in time I think we are pretty comfortable bedding on a move to the 2.0000 handle.

Longer-term uptrend

The British pound of course is in a longer-term uptrend against most currencies, and the Canadian dollar course is suffering due to the fact that the oil markets are so soft. Ultimately, the oil markets are doing absolutely no favors for the Canadian dollar, and as a result I think that it’s only a matter of time before the Canadian dollar capitulates a little bit. Even if we pullback from here, I think that is just an invitation to start buying in that will be especially true if we find buyers near the 1.95 level, as it has been so resistive in the past, and supportive recently. Because of this, I am very bullish of this pair.

I do recognize that the 2.0000 level will offer quite a bit of resistance, and perhaps that’s all we are doing right now, simply building up enough momentum to take that level on. With that being the case, keep an eye on the GBP/USD pair, as it looks like it is well supported on the weekly chart, at the 1.55 handle. If that pair goes higher, this pair should as well.