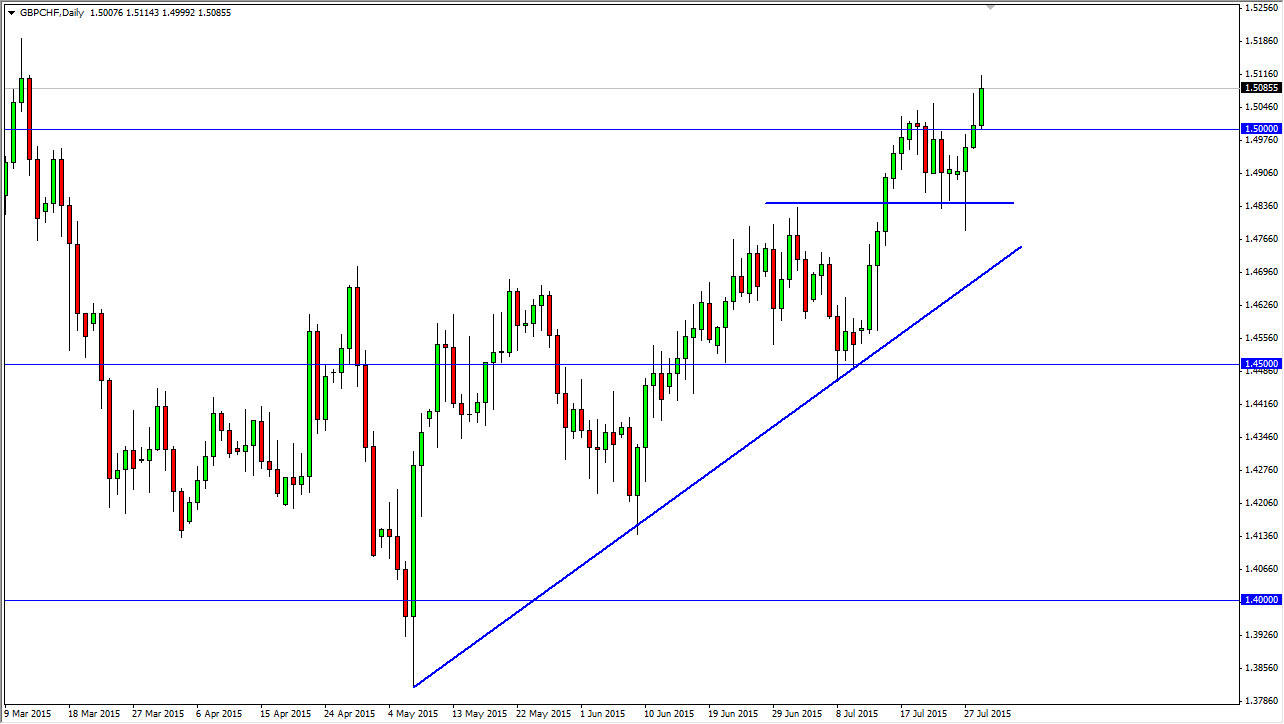

The GBP/CHF pair broke higher during the course of the session on Wednesday, clearing the top of the shooting star that formed on Tuesday. Because of this, the market looks as if it is going to continue to go higher, and now that the market has surged much higher than the 1.50 level, I think that it’s only a matter of time before we continue to go towards the 1.55 level. This is a pair that tends to be fairly dramatic in its moves, so having said that I am a buyer of dips as this market should continue to strengthen.

After all, the Swiss National Bank has been working against the value of the Swiss franc in general, and that of course has a bit of a “knock on effect” on this particular pair. Yes, the Swiss have more than likely been intervening in the EUR/CHF pair again, but truthfully they have intervened in this market in the past. Because of that, this market could be moved to buy that as well. There could be simple fear in this marketplace.

Longer-term uptrend?

We aren’t too far from breaking out to the upside, and the 1.52 level should send this market looking for a longer-term uptrend for traders to enjoy. It’s only a matter time before that happens, so this point in time, we have a “buy on the dips” type of market. The line on the chart that is near the 1.45 zero level should be supportive as well, so having said that we feel that the market will eventually show strength from time to time and on top of that you have a positive swap in this pair so course a lot of traders will just simply hang on to the position as it pays them to wait for strength. In fact, at this point in time I don’t really have a scenario in which a willing to sell this market right now, as the Swiss franc is a currency that I have no interest whatever in owning.