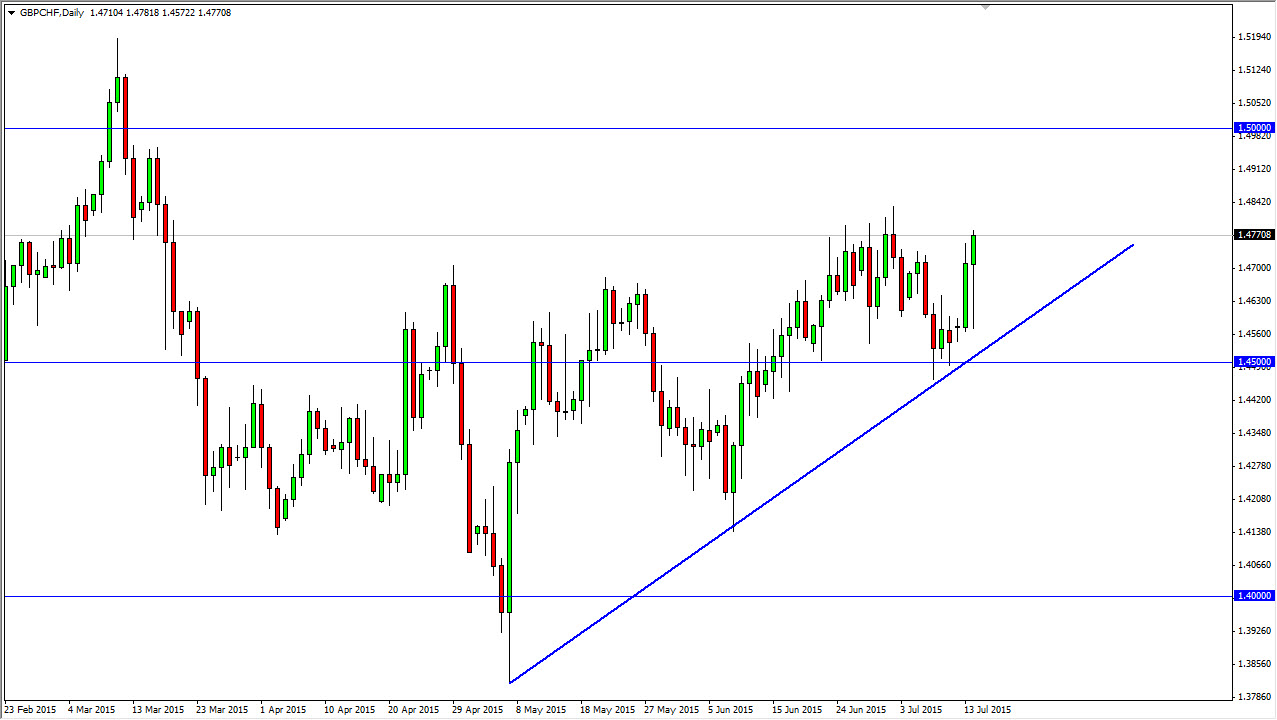

The GBP/CHF pair fell during the course of the session on Tuesday, but found enough support just above the previous uptrend line to turn things back around and form a nice-looking hammer. The hammer sits just below the 1.48 level as the market continues to push much higher. The hammer of course is a very bullish sign, and as a result I believe that the British pound will continue to strengthen against the Swiss franc.

On top of that, you have to keep in mind that the Swiss National Bank continues to work against the Swiss franc, and has recently admitted to being involved in the Forex markets. With that being the case, I believe that if we can break above the 1.48 level, we should then head to the 1.50 level which of course is a large, round, psychologically significant number.

British pound strength? Or is it Swiss intervention?

You could say that it is British pound strength that is driving this market, or you could question whether or not it isn’t something due to the Swiss National Bank being involved. Ultimately, it doesn’t really matter, because both of those are good enough reasons for this market to go higher. Also, I believe that the British pound itself is starting to show real signs of life anyway, and when you pair it off with a currency that is being sold by its own central bank, it makes sense that the market should continue much higher.

I believe that the uptrend line should hold, and as long as it does it should be a signal that you can only buy this market. With that, there’s no situation where I want to sell this market at this moment in time. I believe that there is enough support not only at the uptrend line, but at the 1.45 level to keep this market afloat anyway. So having said that, I am a buyer but I recognize that we could have a bit of volatility between here and the 1.50 level.