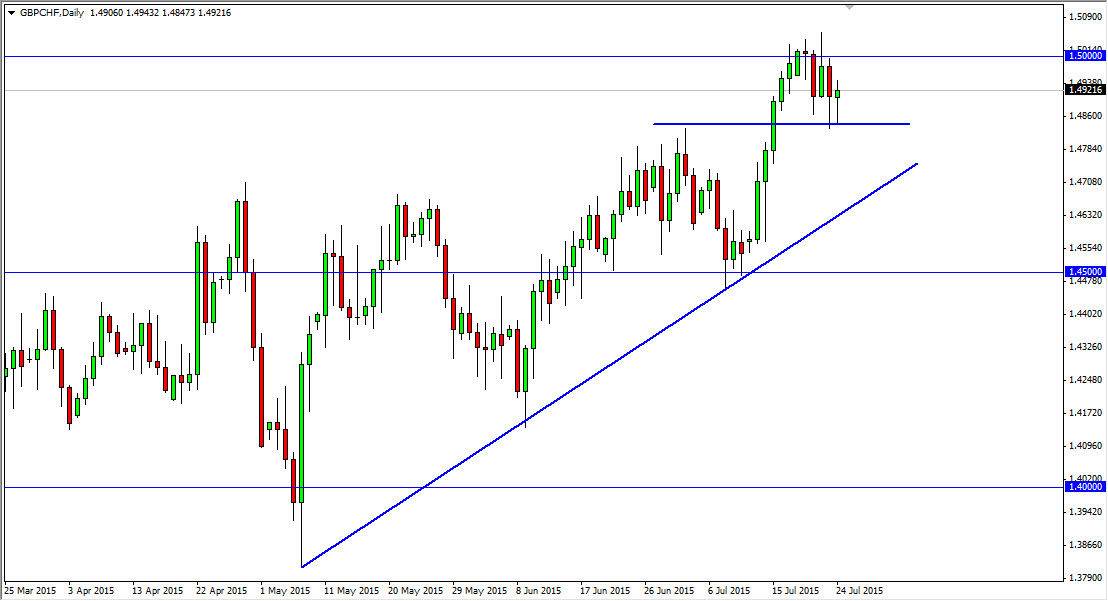

The GBP/CHF pair initially fell during the course of the session on Friday, but found enough support near the 1.4850 level in bounce significantly and form a nice-looking hammer. This hammer of course is a bullish sign, so if we can break above there I feel that the market will probably head back to the 1.50 level, and then break out above there. Once we get that breakout, this market should continue to go much higher, as the British pound is favored in general.

Keep in mind that the Swiss National Bank has been working against the value of the Swiss franc in general, although they tend to be involved in the EUR/CHF pair more than anything else. Nonetheless, it does have a bit of a “knock on effect” against the Swiss franc in general. With that, and the fact that the British pound has been a bit stronger than most other currencies, leads me to believe that this is a very strong move waiting to happen.

Uptrend line

I believe that the uptrend line below should continue to push this market higher. With this, the market should continue to find buyers even if we break down below the 1.4850 level, as there is so much noise below. The market should continue to find buyers overall, especially now that the stock markets have pulled back significantly, which means that the markets will more than likely find value investors, and that should bring up confidence in general when it comes to other markets, including this one.

If we get above the 1.50 level on a longer-term move, I believe that will now be support. This is pretty significant resistance at the moment, but it should now be support based upon the basic tenets of technical analysis. I think that this could be a longer-term “buy-and-hold” type of situation, and we can also buy this pair retracement dips. I have no interest in selling at the moment, and it’s only a matter of time before we start to show strength yet again.