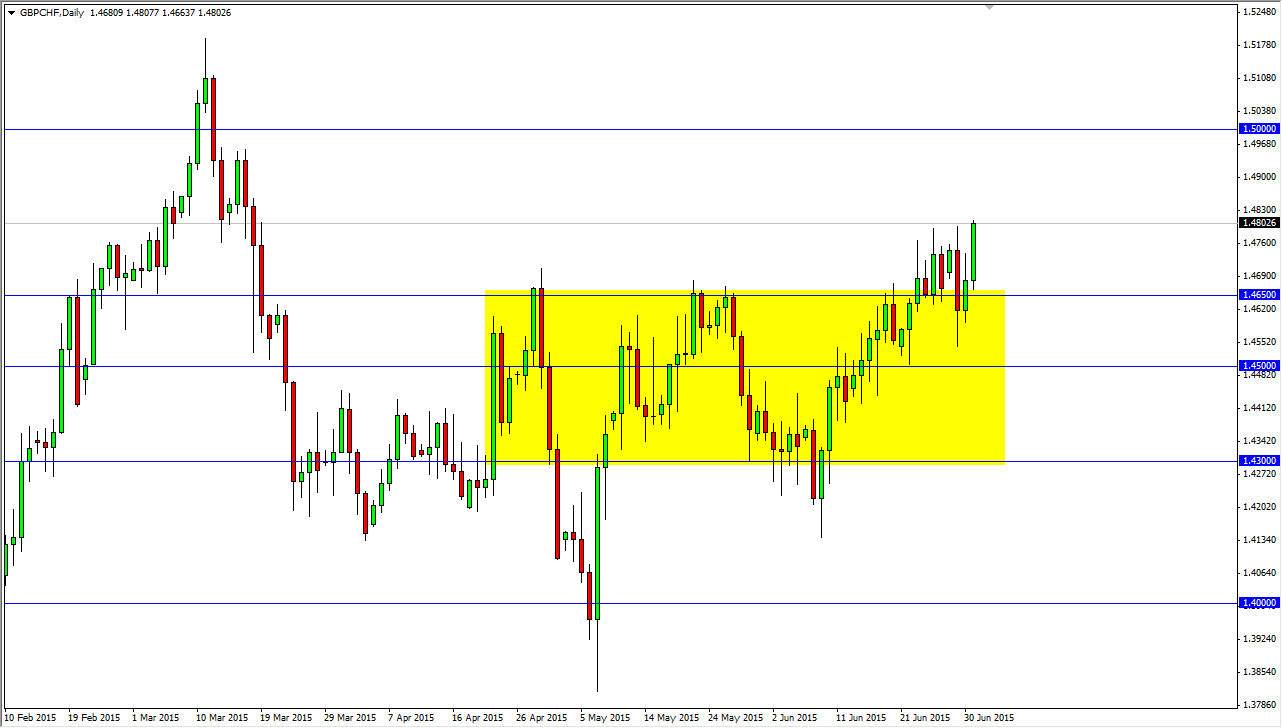

The GBP/CHF pair initially dropped a bit during the session on Wednesday, but found enough support near the 1.4650 level to turn things back around and break above the 1.48 level. I believe that this market is ready to go higher, if we can break above the top of the range for the session. Granted, today as Nonfarm Payroll numbers coming out of the United States, and the Independence Day holiday will be celebrated on Friday and Saturday, so there will be some volatility in this market regardless of what happens.

Regardless though, I believe that there is plenty of support near the 1.4650 level. Because of this, pullbacks should be thought of as call buying opportunities or opportunities to go long in the spot Forex market. I believe that the British pound continues to strengthen overall, especially against the Swiss franc as the Swiss franc is so heavily exposed to the European Union.

Athens

The one thing that could rattle this pair is if Athens does something brash, having money flood into so-called “safety currencies” such as the Swiss franc. With that, we could drop a bit lower but at that point in time I believe that we would simply be offered quite a bit of value. I like the British pound quite frankly, and as a result I am a buyer of that currency against most other currencies. Granted, this is a little bit of an outlier type of cross, but at the end of the day I think that the technical analysis suggests that we are in fact going to head towards the 1.50 level, which of course is a large, round, psychologically significant number.

Pullbacks on short-term charts should continue to be buying opportunities, and more than likely any knee-jerk reaction coming out of the US jobs markets will more than likely be reversed given enough time. I remain bullish of this pair, at least for the time being.