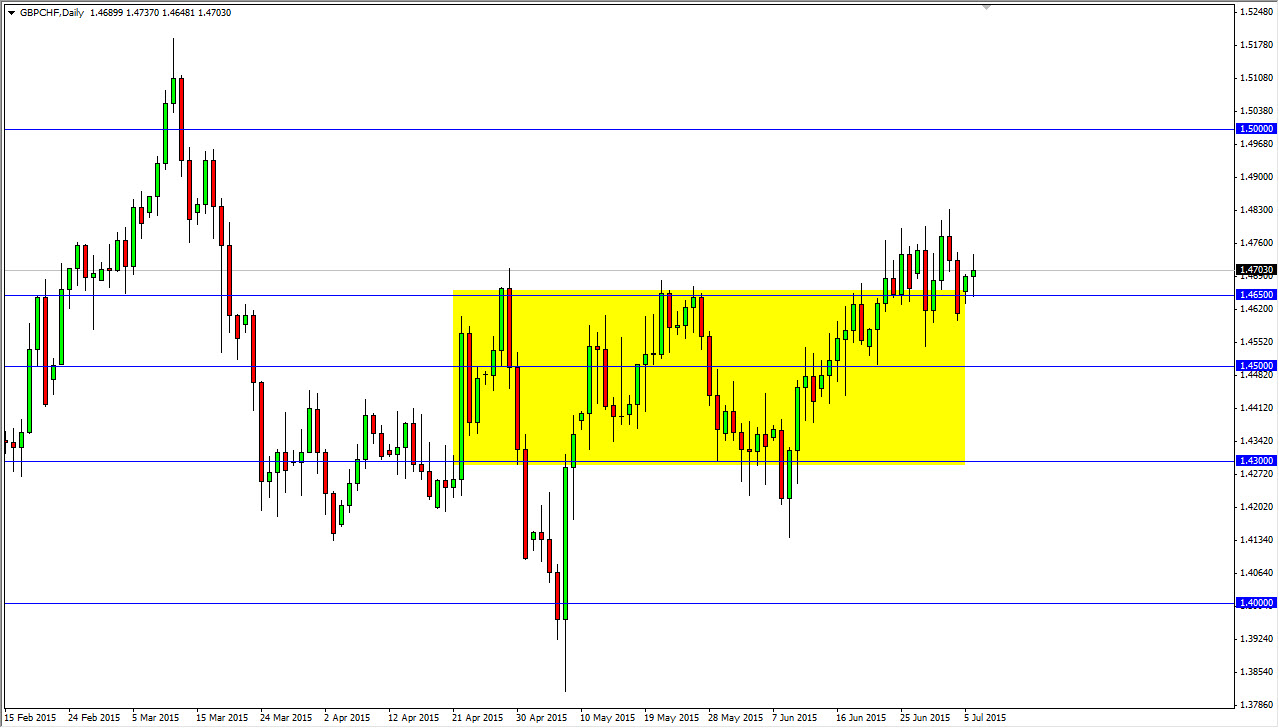

The GBP/CHF pair broke higher during the course of the session on Monday, and then started to look for support at the 1.4650 level. It did in fact find it, and as a result it looks as if the market is ready to continue to go higher given enough time. With this, I am a buyer of short-term pullbacks as I believe the British pound itself is doing fairly well.

The British pound is one of my favorite currencies at the moment, and I believe that the recent consolidation between the 1.43 level and the 1.4650 level will continue to offer support, making the market eventually go higher. I also believe that the Swiss franc will probably be less desirable than the British pound just because of the Swiss reliance on the European Union and all of what goes on within those borders.

Grind higher

I believe that we are going to grind higher more than anything else. I think that we will eventually reach towards the 1.50 level, but it is going to be rather slow going as there are a lot of moving pieces in the world economic Outlook, and I believe that the market still will favor the Swiss franc over many other currencies, so that will keep this pair a little bit sluggish as compared to what I would normally expect.

Nonetheless, I think that every time we rally and then pull back, we are looking at a short-term buying opportunity or the ability to add to a larger core position. I think that it’s only a matter of time before we reach towards the 1.50 level which of course is such a large, round, psychologically significant number. The markets of course will be attracted to the “wholeness” of that number, as longer-term charts typically will show.

As far selling is concerned, we would have to break below the 1.45 level for me to think about it. I believe that a move below the 1.43 level would be very bearish, and at that point time I would become more bearish for the longer term.