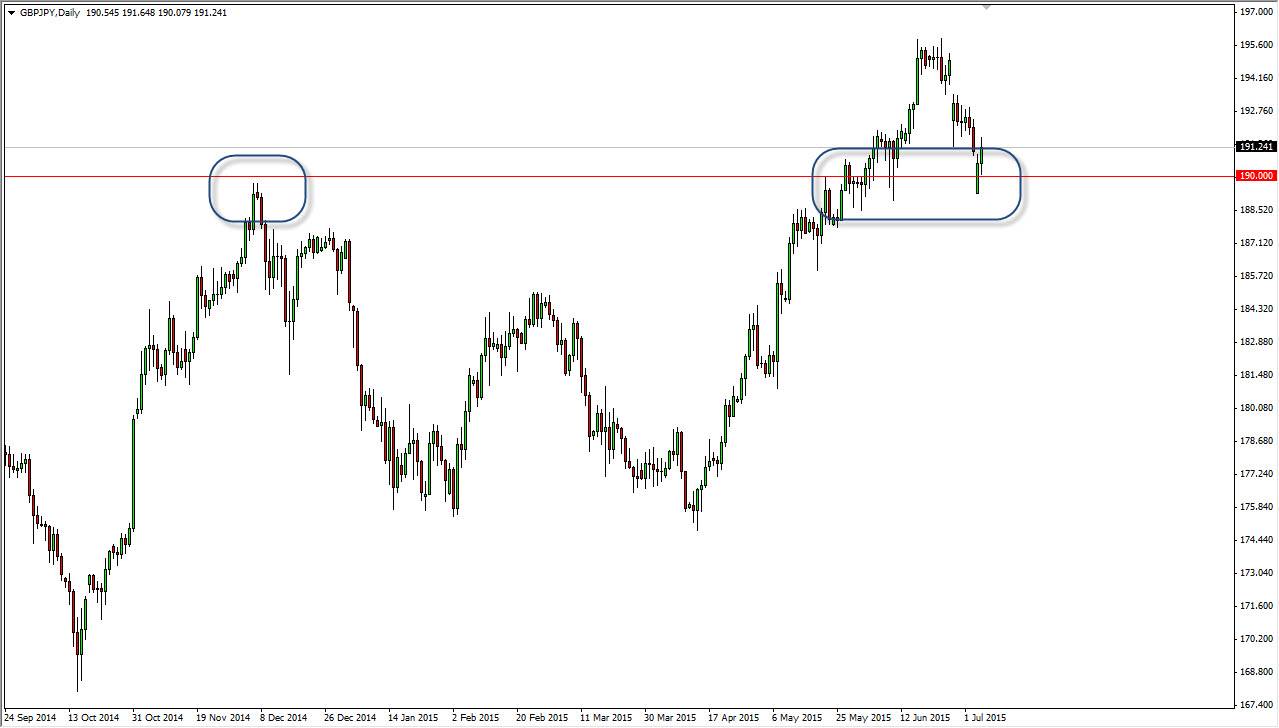

The GBP/USD pair initially gapped lower at the open on Monday as the announcement of the Greek referendum vote sent shockwaves through the newswires. However, you can see that we shot straight higher, breaking above the 190 level yet again. Because of this, we filled the gap and even went higher than that at one point. I believe that the British pound is one of the best performing currencies in the world right now, and of course the Japanese yen isn't exactly much to look at.

Yes, the Japanese yen is considered to be a “safety currency”, and as a result money would have certainly flowed into Japan. However, that was turned around so rapidly that I think the uptrend simply continues from here. On a break above the top of the range for the session on Monday, I have no hesitation whatsoever from buying this pair, and I believe we head back towards the 195 handle given enough time.

Don’t forget the swap

Don’t forget the swap either, because after all that is part of what drives the currency pair. You get paid to simply hold this pair over the longer term. With that, it makes sense that the British pound being a stronger currency overall and the swap being in your favor on the upside should continue to propel this market much higher. In fact, I believe that before to too awfully long we will be talking about a 200 print.

I still believe that pullbacks offer buying opportunities as well, so therefore I believe that you can add to your position as time goes along. I believe that the market will continue to favor the British pound over most other currencies in the world, and with the Bank of Japan feverishly working against the value of the Yen, it makes perfect sense that the quantitative easing coming out of Tokyo will continue to push this pair higher over the longer term as well. This is one of my favorite pairs.