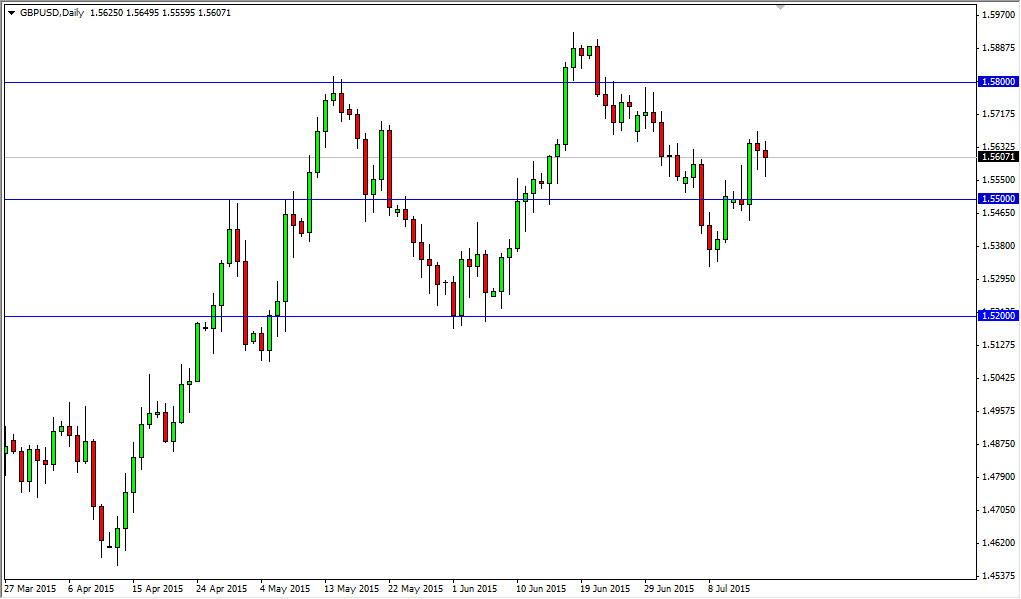

The GBP/USD pair initially fell during the course the day on Thursday, breaking below the 1.56 handle. That being the case, the market looks as if there are plenty of buyers underneath and as a result we bounced to form a bit of a hammer. That hammer mirrors the hammer that formed on Wednesday, and as a result it looks as if the market is ready to continue going higher. Ultimately, I believe that the market will find a bit of a ceiling at the 1.58 handle, which was resistance previously. That being the case, I feel that this is a market that can only be bought, and a break above the top of the hammer of course is a good signal. On the other hand, we could drop down from here, but I think pullbacks will only offer buying opportunities as well

British pound, the exception

I think that this is one of the few exceptions that you can actually go against the US dollar. The US dollar looks strong against their Euro, the Swiss franc, and of course the Japanese yen. With this, I feel that it’s only a matter of time before we will get volatility due to the fact that the US dollar is so strong in general, but the British pound of course seems to be doing much better than most other currencies around the world. Whether or not we can get above the 1.58 level might be a completely different question, but my suspicion is that sooner or later we will in fact break above that level.

I think that once we break above 1.58, we will then reach towards the 1.60 level which is my longer-term target anyway. I believe that we will continue to see the uptrend in the British pound and have no interest in selling until we get well below the 1.55 handle, and more realistically the 1.5250 level. I continue to buy on dips.