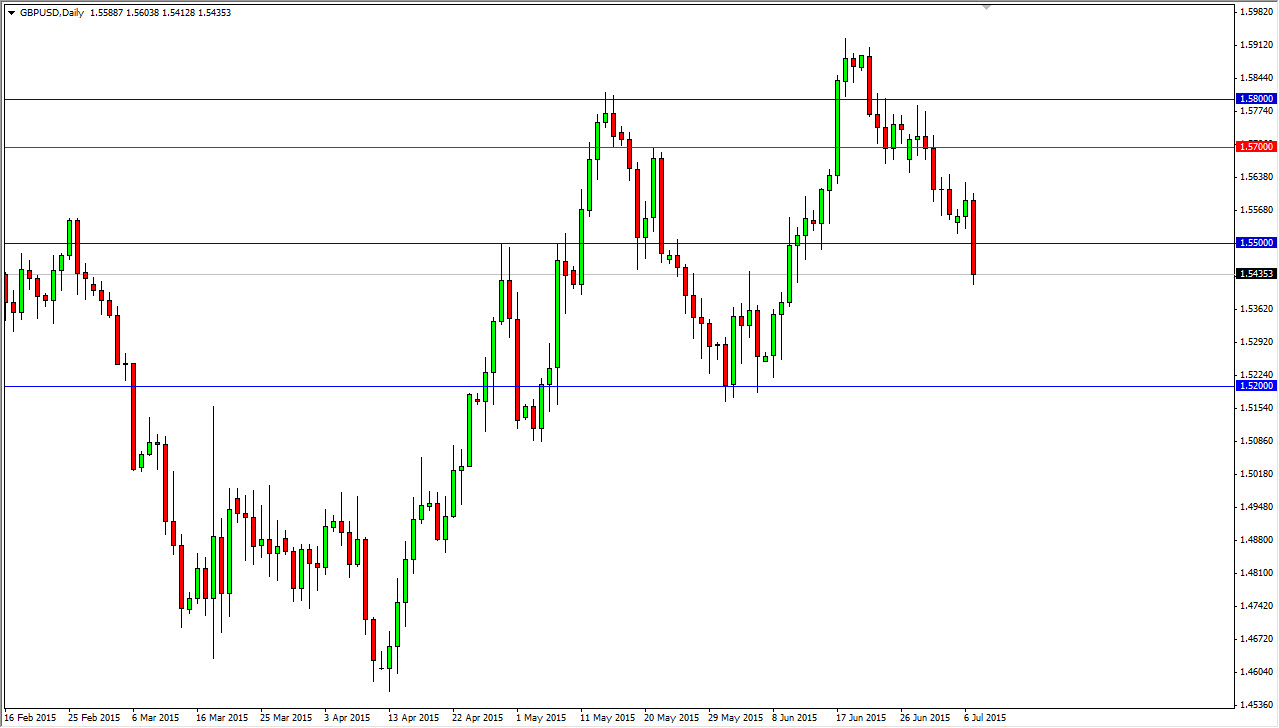

Looking at the GBP/USD pair, you can see that we fell rather significantly during the session on Tuesday. Breaking below the 1.55 level is in fact a very bearish sign, as I recently had stated that the 1.55 level should be a bit of a “floor” in this market. Now that we are broken below there, I think the market should then head towards the 1.52 level, which is the next significant support barrier. However, you have to keep in mind that the markets are not necessarily trading on technicals, but rather on fear and greed at the moment. After all, the Greek referendum vote has scared quite a few participants, and as a result there was a rush to the US dollar on Tuesday.

All things being equal though, I believe that the British pound will continue to strengthen over the longer term, but I’m not ready to start buying yet. In fact, I fully anticipate this market heading to the 1.52 level first. Of course, things could change if the Greeks suddenly decide to fall in line with the austerity measures, but that doesn’t look very likely at the moment.

Volatile summertime trading

Summertime tends to have a lot less liquidity than other times of the year, and as a result it’s not a big surprise that the markets would suddenly fall apart on bad news. However, at the end of the day I still believe that the market is trying to form a bit of an upward channel. However, having said that I would be very bearish and we broke down below the 1.52 handle, because at that point in time we would be making a “lower low.” That of course is the absolute epitome of a downtrend, and it changes everything at that point in time.

I will wait for supportive candle in order to get involved to the upside though, so at this point in time there is in a whole lot that I’m going to be doing rather than simply observing the markets and will keep you abreast of my opinion at the end of the day when I see the right candle.