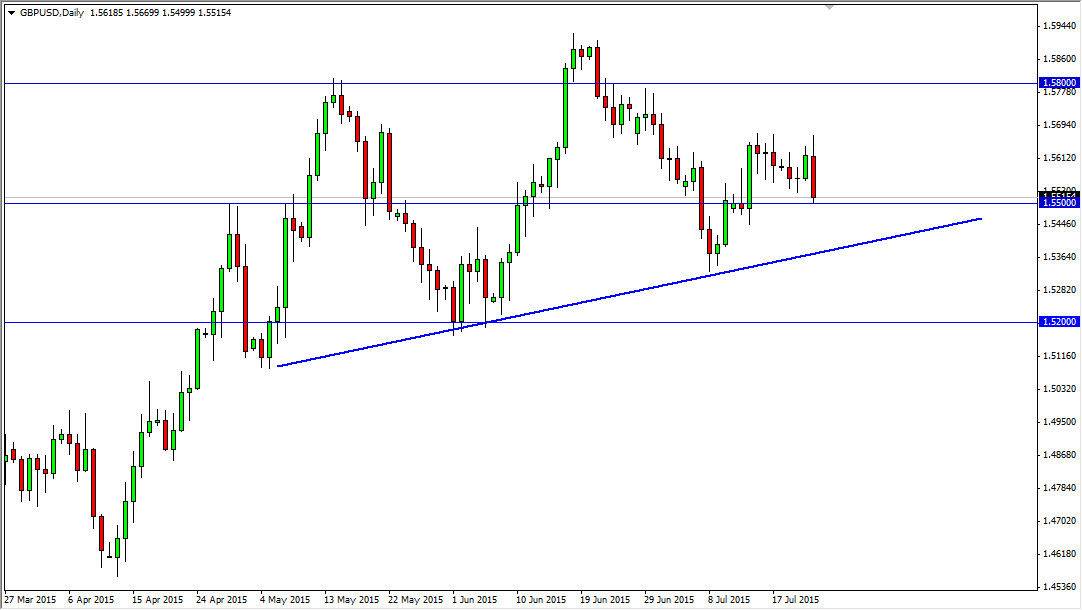

The GBP/USD pair initially tried on Thursday, as the 1.57 level offered far too much in the way of resistance. The market fell significantly at that point in time, and crashed into the 1.55 level. This area should be important, but I see a more important line below, as shown by the uptrend line on the chart attached. This market of course is reacting to the absolutely horrible Retail Sales numbers that came out of the United Kingdom, as last month produced a -0.2% number, when 0.4% was expected. However, we are technically still in the channel that you can see on this chart.

The pair will of course struggle from time to time, as the US dollar is of course the favored currency around the world. The markets have liked the Pound, but in the end the Dollar is strong as well. The pair would of course have to contend with the questions about the Federal Reserve and how many times it is going to raise rates, so there will be hiccups again and again.

1.52, the “floor”

I believe that the 1.52 level will serve as a “floor” at this time, and as a result I am not interested in selling until we close below that level on a daily close. The markets will probably have a serious fight there, but I would have to start selling if we get below the trend line, and going below the 1.52 level is just another signal of weakness.

The move to the upside could very well reach towards the 1.58 level, which acted as resistance previously. However, we did break above it slightly, meaning that this pair will go to the 1.60 level, which of course is a large, round, and important figure in the markets.

No matter what, I think volatility will be a huge factor in this market, as it will be in most pairs. So because of this, I am keeping any trades small at this point in time.