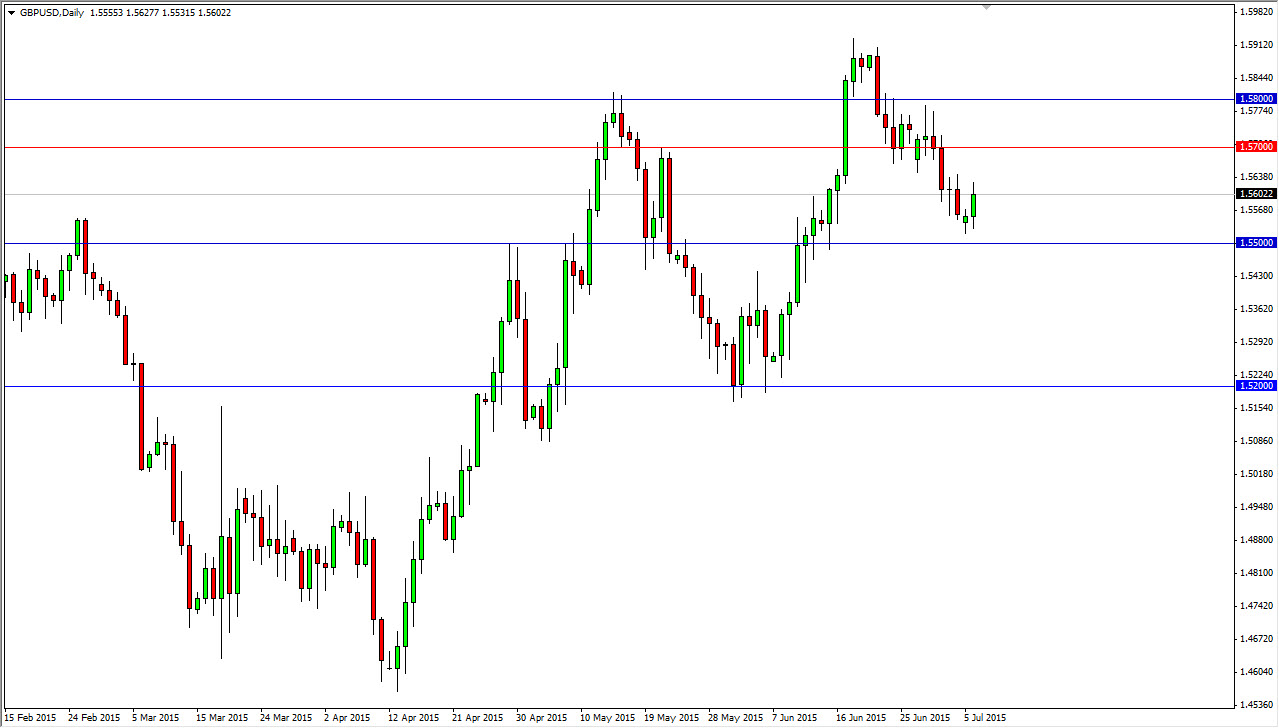

The GBP/USD pair initially fell during the session on Monday, as the market of course reacted to the Greeks voting “no” when it comes to the referendum. Because of this, there was a lot of risk aversion out there in the marketplace, and it was only a matter of time before the markets ran for cover. However, the market looks as if it is well supported below the 1.55 handle, an area that I had suggested needed to hold for the buyers to remain in control over the longer term. Because of the nice bounce that we got during the Monday session, I am more convinced of British pound strength than ever.

You have to keep in mind that even though we initially had a bit of a knee-jerk reaction for safety, the reality is that risk assets actually did fairly well as the day progressed. With this, I believe that the market is still in the process of trying to form a longer-term uptrend. With that, I am a buyer.

Looking to buy pullbacks

I am looking to buy pullbacks as we go higher over the longer term, as I believe we will start reaching towards the 1.57 level, and then eventually the 1.58 level. I believe that we will also break above there and reach towards the 1.60 level given enough time. Ultimately, the market looks as if it wants to go much higher over the longer term, so it seems as if it will probably make sense for the buyers to continue to be aggressive based upon “value” on the pair dropping.

If we did break below the 1.55 level, I feel that point in time the market will probably head towards the 1.52 handle, and then maybe even the 1.50 level from there. However, at this point in time I believe that the upside is probably more likely. After all, we have had a bit of a pullback here recently, but it wasn’t outrageous in retrospect, and it was roughly 50% of the most recent leg higher.