GBP/USD Signals Update

Yesterday’s signals expired without being triggered.

Today’s GBP/USD Signals

Risk 0.75% per trade.

Trades may only be made between 8am and 5pm London time today.

Short Trade 1

- Short entry following a bearish price action reversal on the H1 time frame immediately upon the next touch of the broken bearish channel trend line currently sitting at around 1.5470.

- Place the stop loss 1 pip above the local swing high.

- Move the stop loss to break even once the trade is 25 pips in profit.

- Take off 50% of the position as profit when the price reaches 1.5350 and leave the remainder of the position to run.

Short Trade 2

- Short entry following a bearish price action reversal on the H1 time frame immediately upon the next touch of 1.5481.

- Place the stop loss 1 pip above the local swing high.

- Move the stop loss to break even once the trade is 25 pips in profit.

- Take off 50% of the position as profit when the price reaches 1.5350 and leave the remainder of the position to run.

Short Trade 2

- Short entry following a bearish price action reversal on the H1 time frame immediately upon the next touch of 1.5530.

- Place the stop loss 1 pip above the local swing high.

- Move the stop loss to break even once the trade is 25 pips in profit.

- Take off 50% of the position as profit when the price reaches 1.5350 and leave the remainder of the position to run.

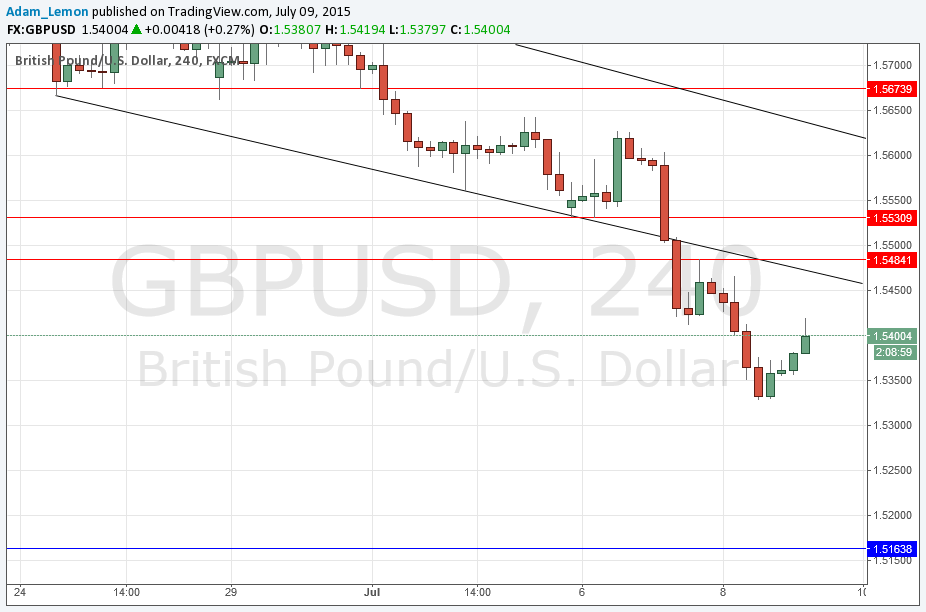

GBP/USD Analysis

It was a fairly simple story yesterday of a fall before the FOMC release, followed by a recovery afterwards. This was really due to the USD and not the GBP. Today it will be the GBP’s turn to react to some key data. There are still no key supportive levels anywhere nearby but plenty of resistance above, as can be seen from the chart below. Any spikes up to these levels could provide good shorting opportunities today.

Regarding the GBP, at Noon London time there will be a release of the Bank of England’s Official Base Rate and the MPC Statement, which is the key event of the month. Later at 1:30pm there will be a release of U.S. Unemployment Claims data.