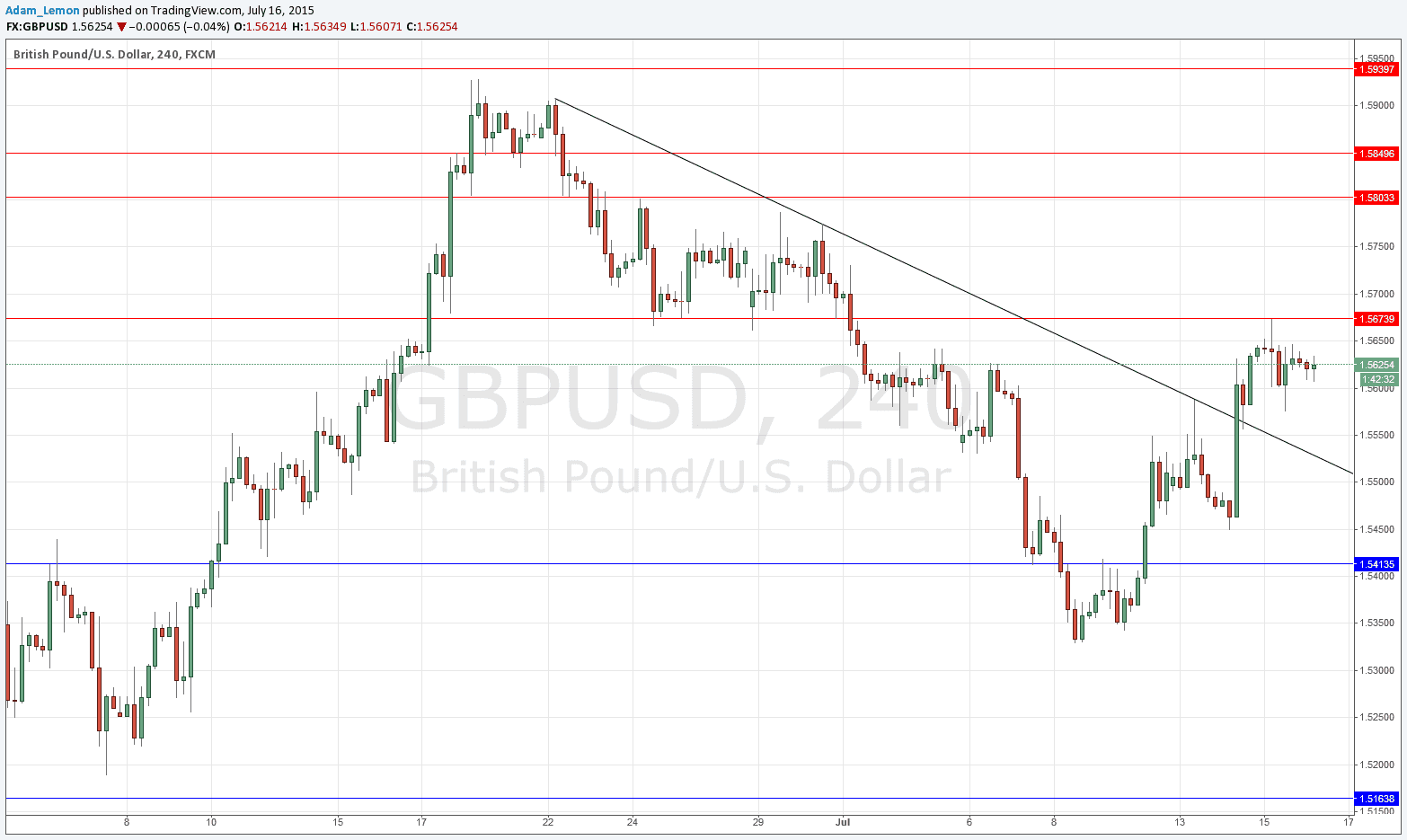

GBP/USD Signals Update

Yesterday’s signals produced a profitable short trade off the bearish reversal at 1.5674.

Today’s GBP/USD Signals

Risk 0.75% per trade.

Trades may only be taken before 5pm London time today.

Short Trade 1

- Short entry following a bearish price action reversal on the H1 time frame immediately upon the next touch of 1.5674.

- Place the stop loss 1 pip above the local swing high.

- Move the stop loss to break even once the trade is 25 pips in profit.

- Take off 50% of the position as profit when the price reaches 1.5610 and leave the remainder of the position to ride.

Short Trade 2

- Short entry following a bearish price action reversal on the H1 time frame immediately upon the next touch of 1.5803.

- Place the stop loss 1 pip above the local swing high.

- Move the stop loss to break even once the trade is 25 pips in profit.

- Take off 50% of the position as profit when the price reaches 1.5710 and leave the remainder of the position to ride.

Long Trade 1

- Long entry following a bullish price action reversal on the H1 time frame immediately upon the next touch of the broken bearish trend line currently sitting at around 1.5525.

- Place the stop loss 1 pip below the local swing low.

- Move the stop loss to break even once the trade is 25 pips in profit.

- Take off 50% of the position as profit when the price reaches 1.5550 and leave the remainder of the position to ride.

GBP/USD Analysis

Although the USD started to strengthen yesterday, and this is in line with the longer-term trend, this pair did not fall much, and this shows that the GBP and the USD are acting right as now as two of the strongest currencies.

It is going to be hard for this pair to move up much as long as the USD remains relatively strong.

Of course, this pair is comprised of the only two currencies whose central bankers are talking up forthcoming rate hikes for their respective currencies.

The best use of this pair would probably be to go long if and when the USD falters.

An advantage of this “stuck” condition is that support and resistance levels are likely to be respected. Anywhere below from 1.0550 to the broken trend line could be supportive.

There is nothing due today regarding the GBP. Concerning the USD, there will be a release of Unemployment Claims data at 1:30pm London time followed by the Fed Chair’s testimony before Congress and the Philly Fed Manufacturing Index at 3pm.