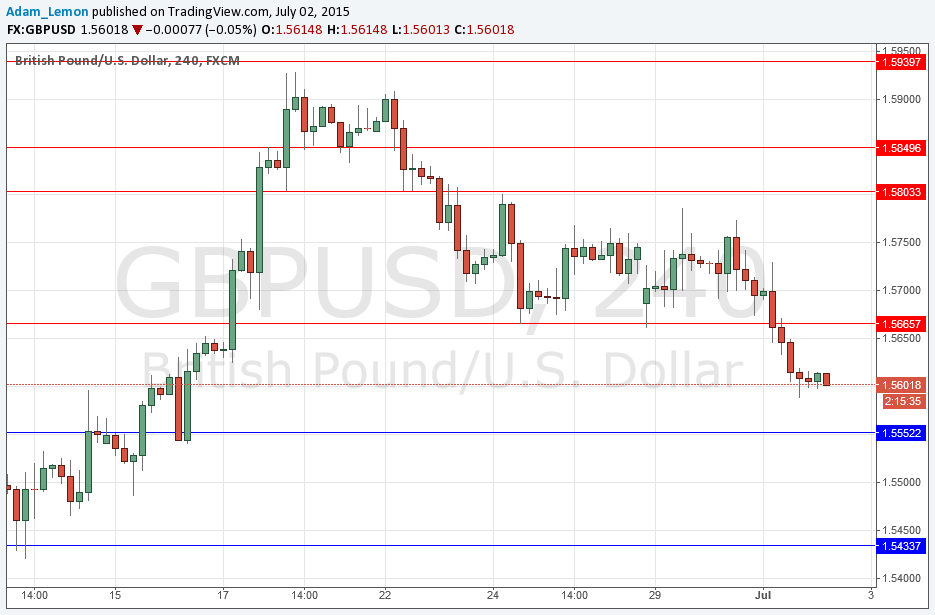

GBP/USD Signals Update

Yesterday’s signals produced a long trade at around 1.5653 which was a losing trade.

Today’s GBP/USD Signals

Risk 0.75% per trade.

Trades may only be taken between 8am and 5pm London time today.

Make sure the risk on any open trade is taken off before 1pm London time.

Long Trade 1

Long entry following a bullish price action reversal on the H1 time frame immediately upon the next touch of 1.5552.

Place the stop loss 1 pip below the local swing low.

Move the stop loss to break even once the trade is 25 pips in profit.

Take off 50% of the position as profit when the price reaches 1.5640 and leave the remainder of the position to ride.

Long Trade 1

Long entry following a bullish price action reversal on the H1 time frame immediately upon the next touch of 1.5433.

Place the stop loss 1 pip below the local swing low.

Move the stop loss to break even once the trade is 25 pips in profit.

Take off 50% of the position as profit when the price reaches 1.5540 and leave the remainder of the position to ride.

Short Trade 1

Short entry following a bearish price action reversal on the H1 time frame immediately upon the next touch of 1.5665.

Place the stop loss 1 pip above the local swing high.

Move the stop loss to break even once the trade is 25 pips in profit.

Take off 50% of the position as profit when the price reaches 1.5560 and leave the remainder of the position to run.

GBP/USD Analysis

The pair fell yesterday after breaking down past support. There are no obvious trend lines and again today there will be key data coming for both sides of the pair. The USD looks strong right now across the board, so a good number for the NFP later should make this pair fall even further. However the GBP has a little strength in it, so there are other currencies that would probably fall further against the USD if that happens.

Regarding the GBP, there will be a release of Construction PMI data at 9:30am London time. Concerning the USD, there will be Non-Farm Employment Change and Unemployment Change data at 1:30pm, one day earlier than usual.