GBP/USD Signals Update

Last Thursday’s signals expired without being triggered as there was no bullish price action at 1.5545.

Today’s GBP/USD Signals

Risk 0.75% per trade.

Trades must be entered between 8am and 5pm London time today only.

Short Trade 1

Go short following a bearish price action reversal on the H1 time frame immediately upon the next touch of 1.5544.

Put the stop loss 1 pip above the local swing high.

Adjust the stop loss to break even once the trade is 25 pips in profit.

Remove 50% of the position as profit when the price reaches 1.5460 and leave the remainder of the position to run.

Short Trade 2

Go short following a bearish price action reversal on the H1 time frame immediately upon the next touch of 1.5673.

Put the stop loss 1 pip above the local swing high.

Adjust the stop loss to break even once the trade is 25 pips in profit.

Remove 50% of the position as profit when the price reaches 1.5580 and leave the remainder of the position to run.

Long Trade 1

Go long following a bullish price action reversal on the H1 time frame immediately upon the next touch of 1.5414.

Put the stop loss 1 pip below the local swing low.

Adjust the stop loss to break even once the trade is 25 pips in profit.

Remove 50% of the position as profit when the price reaches 1.5540 and leave the remainder of the position to run.

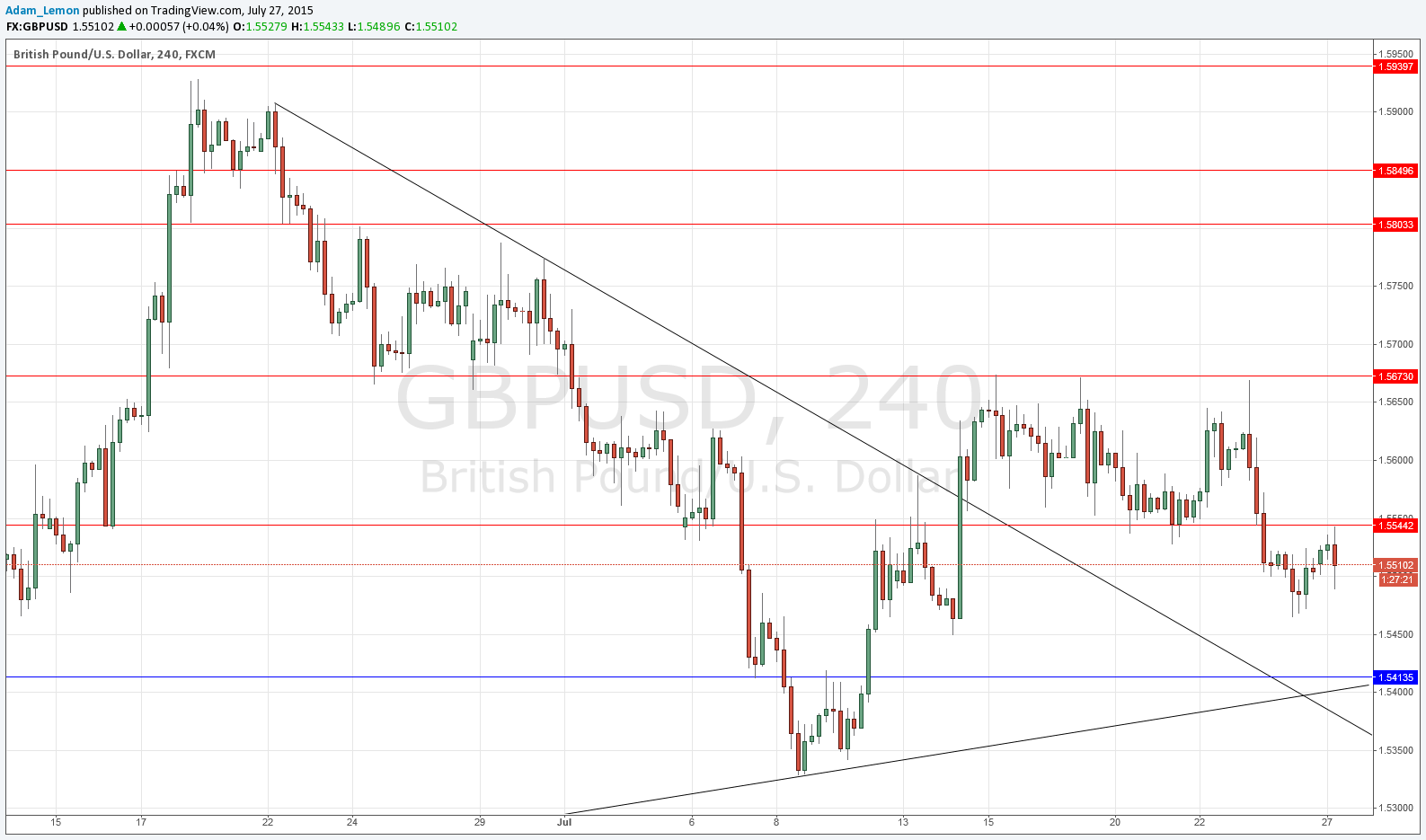

GBP/USD Analysis

Despite the recent strength in the British Pound, the price was unable last week to break above the resistance at 1.5673, and has now printed another resistance level below that, below which the price remains trapped.

However things look very interesting down at the next support of 1.5414 where there is a strong confluence between two trend lines and a key horizontal level. This could be an excellent location to enter a long trade that would pay off if the FOMC Statement on Wednesday disappoints USD bulls.

There is nothing due today regarding the GBP. Regarding the USD, there will be a release of Core Durable Goods Orders data at 1:30pm London time.