Gold turned higher on Wednesday, bouncing off its lowest level in nearly 4 months, as a retreat in the dollar sparked short-side profit taking. The XAU/USD pair traded as high as $1164.59 an ounce but trimmed some of the gains after the minutes from the Federal Open Market Committee's latest gathering showed policy makers intend to hike interest rates sometime this year unless the domestic economy is significantly disrupted by global events. The Committee "saw economic conditions as continuing to approach those consistent with warranting a start to the normalization of the stance of monetary policy", according to records.

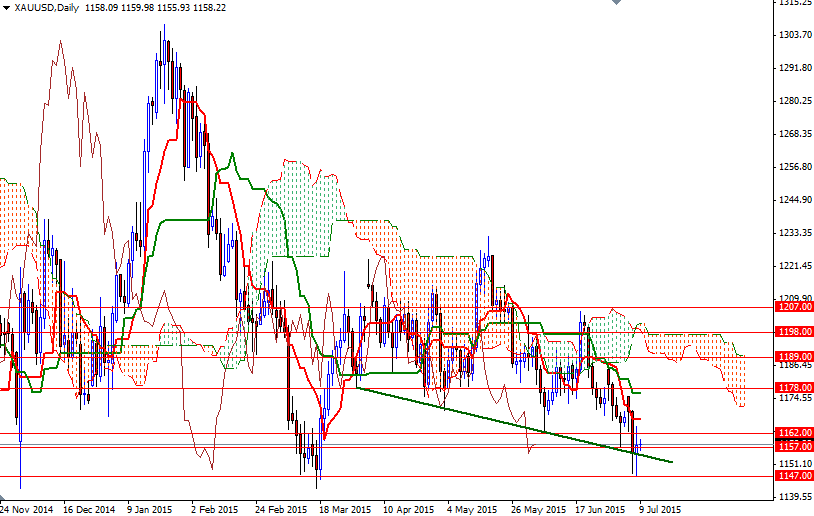

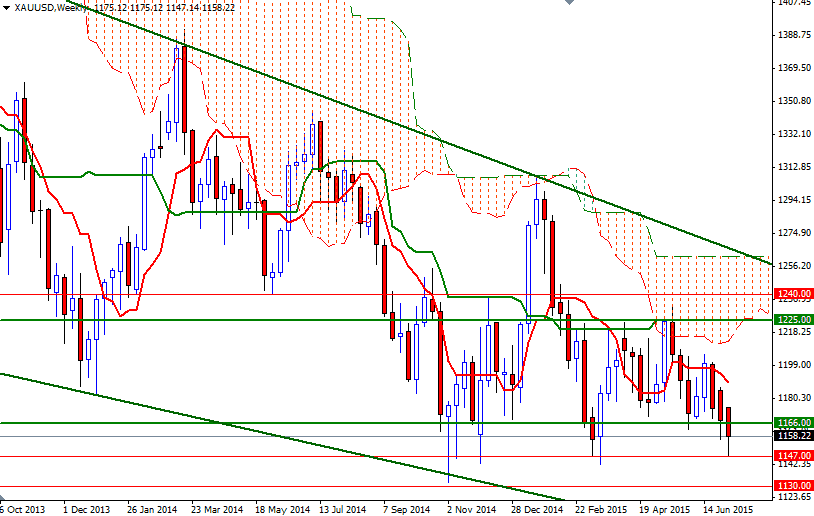

However, they also indicated that they would need to see more evidence that economic growth was sufficiently strong - reinforcing the view that the Fed will wait until September at least. The XAU/USD pair is hovering just above the 1157 support level at the moment but for further gains the bulls will need to push the market above Ichimoku clouds on the 4-hour time frame, the top of the cloud currently sits at 1172. On its way up, expect to see some resistance at 1162 and 1168/6.

On the other hand, if the bears increase downward pressure and the market drops below 1152, it is quite possible that we will retest the support around the 1147 level which played an important role and reversed prices several times. A sustained break above this level would prolong the bearish momentum and clear the path towards 1133/0. Closing below the 1130 level would put us back on track with such a scenario eying subsequent targets at 1114, 1096 and 1083.