Gold prices fell for a third day and settled at $1149.24 per ounce, losing $6.98, as congressional testimony from Federal Reserve Chair Janet Yellen spurred demand for the greenback. The XAU/USD pair fell to four-month lows on Wednesday after she repeated her view that it would be appropriate to start normalising monetary policy this year, if the U.S. economy expands as anticipated. Her comments were basically an extension of her speech on Friday but nevertheless weighed on the market. The greenback also got some support from better than expected economic data. Official figures showed that industrial production rose 0.3% and producer price index advanced 0.4%.

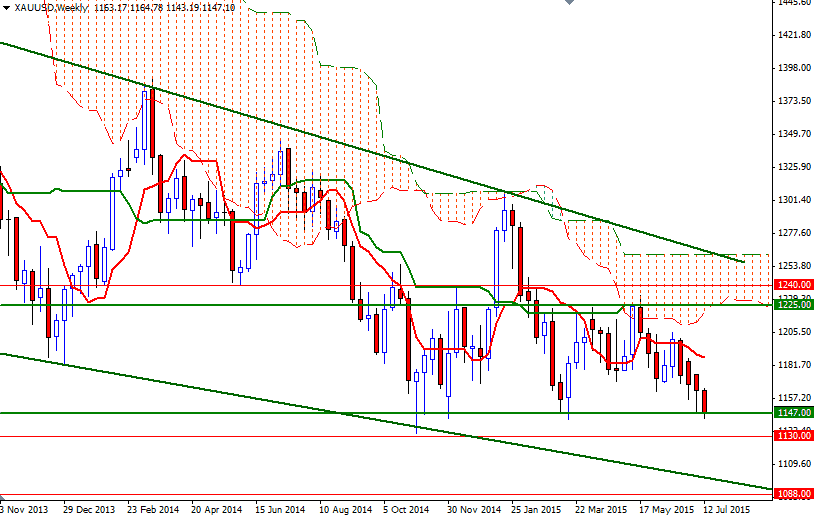

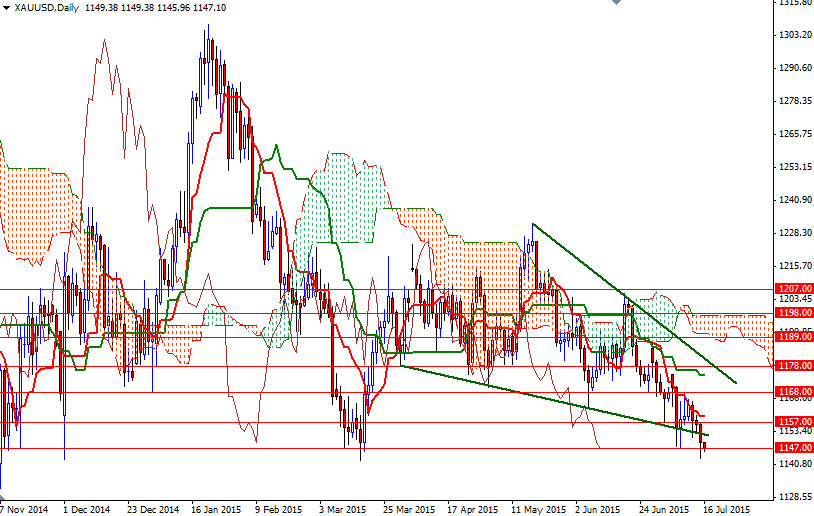

The XAU/USD pair is floating just little above the 1147 level during today's Asian session but we haven't seen a strong reaction so far. The technical picture remains gloomy, with the market trading below the Ichimoku clouds on almost all time frames. Negatively aligned Tenkan-Sen (nine-period moving average, red line) and Kijun-Sen (twenty six-period moving average, green line) lines also create a tough situation for the bulls. Plus, the Chikou-span (closing price plotted 26 periods behind, brown line) is indicative of a downward movement

With these in mind, I think the key levels to watch today will be 1154/2 and 1143. It is quite possible that the XAU/USD pair will continue to fall, targeting the 1133/0 area, if prices drop below yesterday's low. Once below 1130, the bears will be aiming for 1114 and 1096. The bulls will need to pull the market back above the 1254.40 level, where a short-term descending trend line and Kijun-Sen line coincide, in order to approach the next battlefield between 1162 and 1157. A break up above 1162 could see a pull-back going up to 1168.