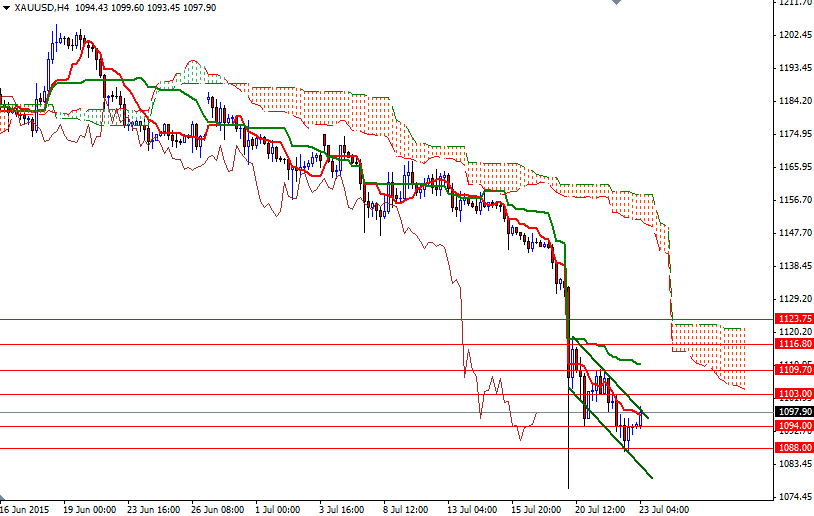

Gold prices dropped $6.75 an ounce yesterday, giving back all of the gains made in the previous session, as a bounce in the dollar drew investors away from the precious metal. The XAU/USD pair headed south after the 1094 level was broken, however the expected support in the 1088/6 zone did kick in and held the market, pushing prices towards the Ichimoku cloud on the 1-hour time frame. The market has been following a descending channel since selling pressure returned around the 1116.80 level.

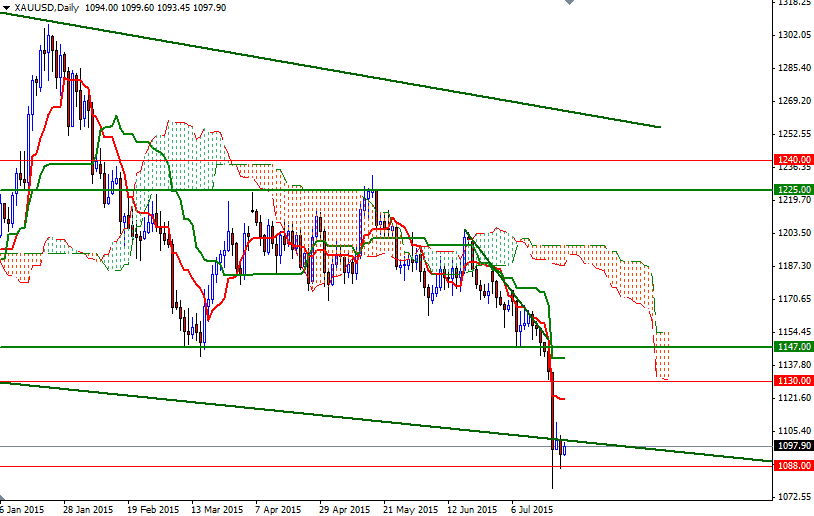

From a technical perspective, the weekly, daily and 4-hour charts suggest that the directional bias remains weighted to the downside. In other words, there will be more resistance to the upside. Basically the overall trend is up when prices are above the cloud, down when prices are below the cloud and flat when they are in the cloud itself. But pattern on the daily chart indicates that prices are unlikely to witness a series of dramatic free falls as we did back in 2013.

With these in mind, I think the key levels to watch today will be 1103/1 and 1094/3. While a successful break above 1103 would set the XAU/USD pair up for a test of the resistance at the 1109.70 level, falling through 1093 could open up the risk of a move towards the 1088/6 region. Once we get through 1109.70, the first tough challenge will be waiting the bulls at the 1116.80 level The bears will have to drag XAU/USD below 1086 so that they can find a new chance to tackle the support at 1071.