Although safe-haven bids pushed up gold prices yesterday after Greece's financial future was thrown into even greater uncertainty, increasing demand for the dollar erased gains entirely. During today's Asian session the XAU/USD pair is trading near Friday's close as equity markets saw a modest rebound on hopes Greece's new proposals will satisfy its international creditors. Euro zone finance ministers are to meet today followed by a full summit of euro zone leaders.

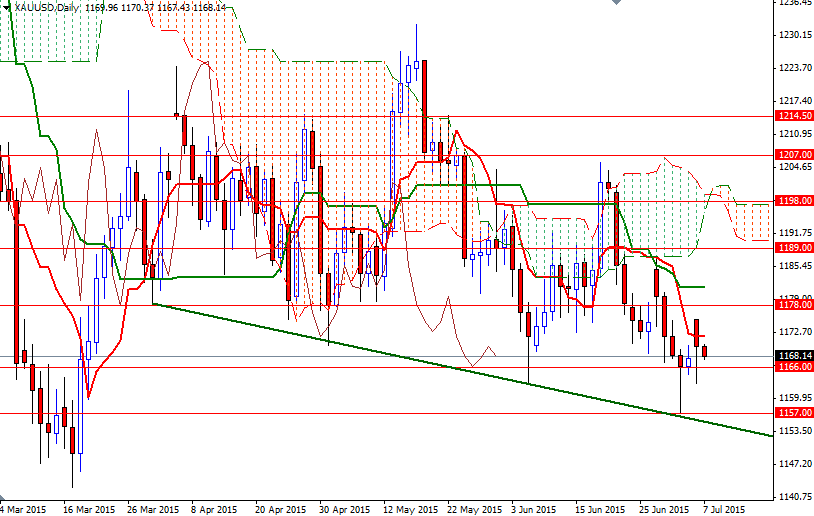

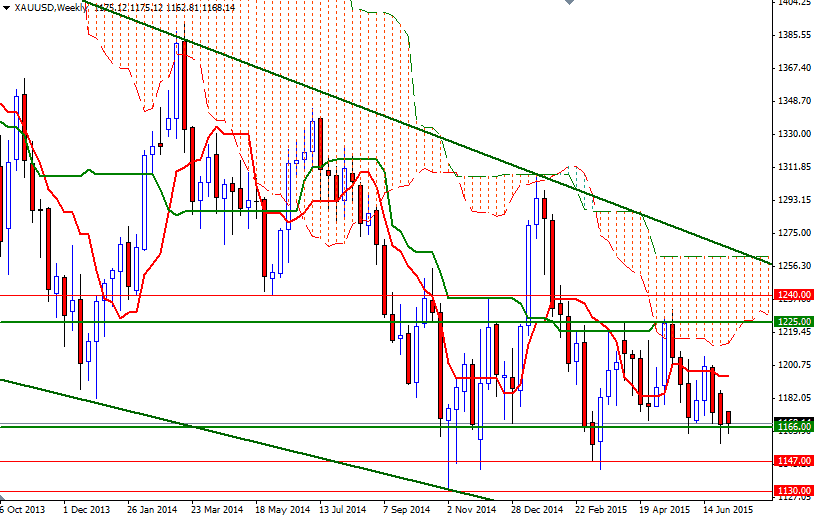

Gold continues to struggle at higher levels but nevertheless has managed to find some support around 1166, suggesting that the range bound nature will persist for now. From a technical perspective, there will be certain amount of pressure as long as XAU/USD trades below the Ichimoku clouds on the weekly, daily and 4-hour time frames. Bearish Tenkan-sen (nine-period moving average, red line) - Kijun-sen (twenty six-day moving average, green line) crosses are also adding to the negative outlook.

To the downside, I will keep an eye on the area between 1166 and 1162. I think that a break below 1162 would trigger a drop towards 1157 which is the next obvious support on the chart. The bears have to capture this point so that they can expand their territory and reach the 1147 level. On the other hand, if buyers take over and prices start to rise, expect to resistance at 1171.86 - 1172.52. Beyond that the bears will be waiting in the 1189 - 1178 zone which is occupied by the clouds on the 4-hour chart.