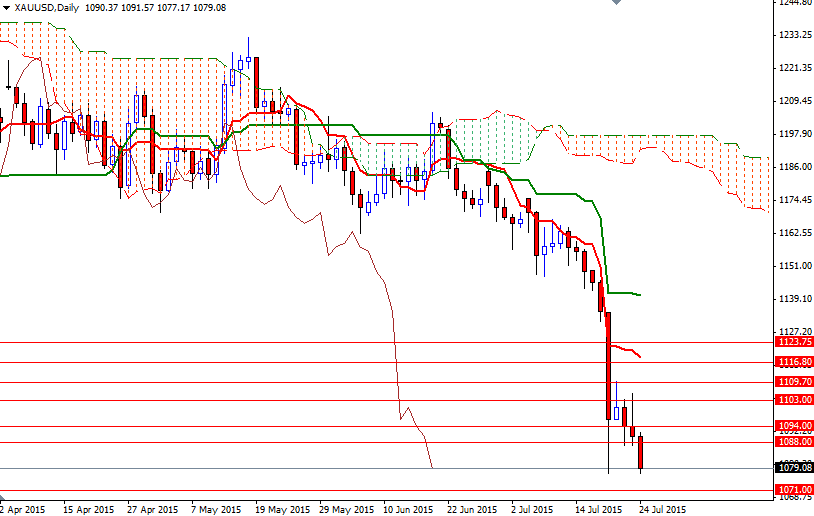

Gold prices initially rose during yesterday's Asian session but the market encountered resistance around the $1103 level as sellers stepped in. The dollar gained strength after a Labor Department report showed that the number of people filing new claims for unemployment benefits dropped by 26K to 25K. As a result, the XAU/USD pair closed back below the $1094 level.

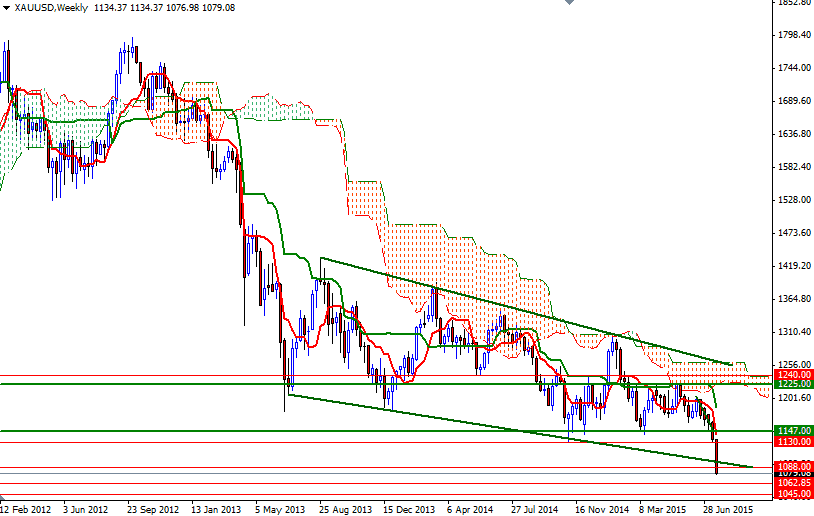

Negatively aligned Tenkan-Sen (nine-period moving average, red line) and Kijun-Sen (twenty six-period moving average, green line) lines, along with Chikou Span/Price cross in the same direction on almost all time frames, makes me think that the technical selling pressure will continue to weigh on the market. The tall upper shadow of yesterday's candle also supports this view.

However, as you can see on the daily chart, the XAU/USD pair is approaching a strategic point by the time of typing. A move below the weekly low could drag the market towards the 1071 level. This is the key level for bears to capture if they are determined to test 1062.95. On the other hand, if the bulls successfully dodge incoming attacks and prices start to rise, we might see XAU/USD returning the 1088 level. Closing back above 1194 would indicate that the market will consolidate for some more time. Until the technical picture changes, any rallies will attract sellers into the market.