Gold settled on Friday at its lowest level in more than five years, as technical pressure and concerns over the prospects of rising U.S. interest rates fueled a loss of more than 2.4% for the week. The metal deepened its losses from the previous sessions after upbeat U.S. economic data boosted speculations that the Federal Reserve is moving closer to altering monetary policy. The Commerce Department said building permits increased 7.4% to a 1.34 million-unit rate and housing starts jumped 9.8% to a seasonally adjusted annual pace of 1.17 million units in June. Separately, the Labor Department's data showed the consumer price index rose 0.3% last month.

I occasionally say the path of interest rates in the United States, performance of the global equity markets and inflation expectations will be the long term drivers. I still believe this will be the case for months. The belief that the Federal Reserve has at least one interest-rate hike coming sometime later this year is supported by firming price pressures and strengthening labor market. As a result, the bearish side of the boat is getting crowded.

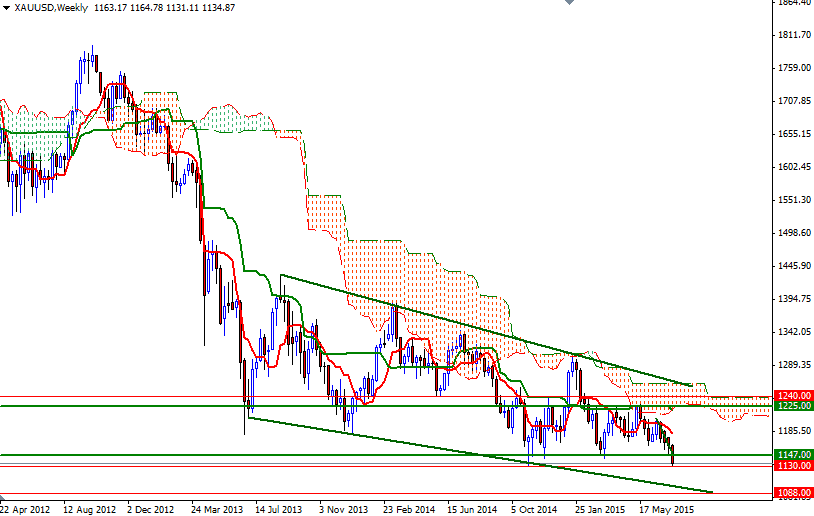

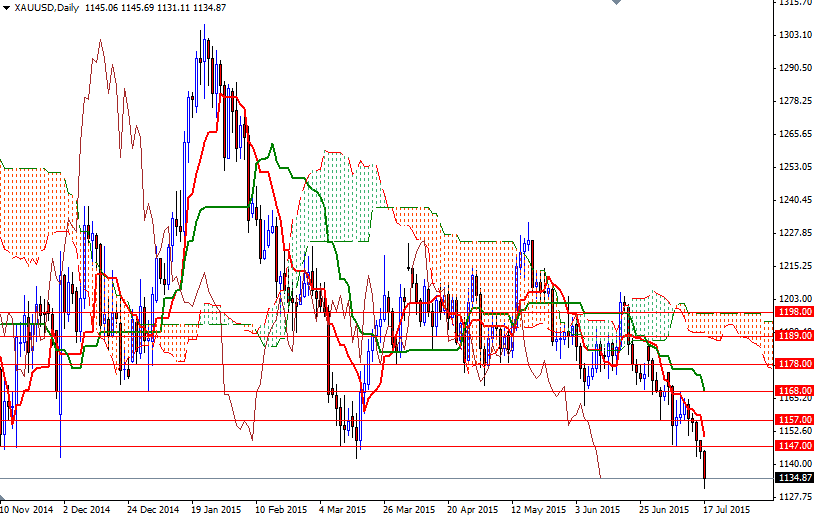

The general bearish downwards drift has suddenly become more pronounced, with the dollar's increasing popularity. While the long-term trend continues to favor the bears, there is a critical support just below, in the 1133/0 area. So, we need to get down below there in order to continue to the downside. If the XAU/USD pair makes a sustained break below 1130, then look for further downside with 1114 and 1096 as targets. However, if prices turn bullish from here, the 1147 level will become a vital point. The bulls will have to pass through 1147, so that they can proceed to the next barrier standing in the 1157/4 area.