Gold snapped three consecutive days of gains as global stock markets and the dollar edged higher on news that euro zone leaders have reached agreement on a bailout for Greece. The new rescue package worth €86 billion is conditional on Greek's government passing all the agreed reforms and it appears that Prime Minister Alexis Tsipras is facing a tough battle to win support from coalition partners.

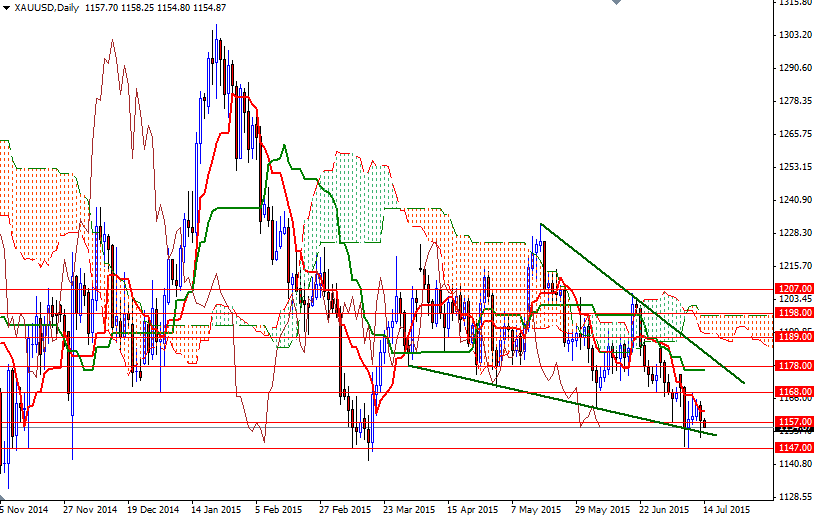

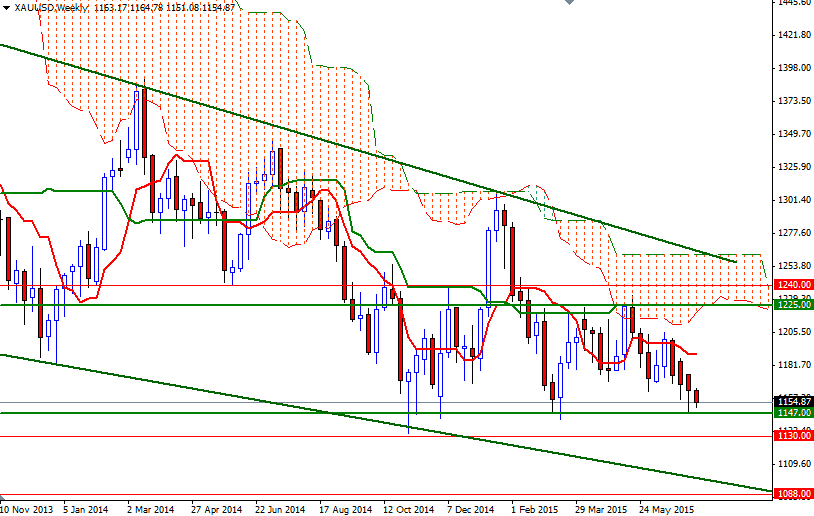

The risk-on attitude across global markets, which is soaring the demand for disaster insurance, will continue to influence the price of gold. With the Greek debt crisis off center stage, the spotlight will return to the U.S. economy. The XAU/USD pair is trading below the $1157 support level as technical pressure weight on the market. It looks like we are heading down to 1147 which is likely to act as effective support in the short-term. But of course, in order to reach there, the bears will have to drag prices below the 1152/1 region. A successful break below the key support at 1147 could see a fall all the way down to 1133/0.

To the upside, there are a bunch of critical resistance levels, with the closest being 1168. Until prices and Chikou-span (closing price plotted 26 periods behind, brown line) anchor above the cloud -on the 4-hour time frame at least- potential gains will be limited. If the bulls manage to defend the 1152/1 support and push the market beyond 1168, then we are likely to proceed to 1172 (and then possibly 1178). Penetrating the barrier blocking the road around 1178 might lure additional buyers into the market and increase the prospect of XAU/USD testing the 1184 and 1189 resistance levels.