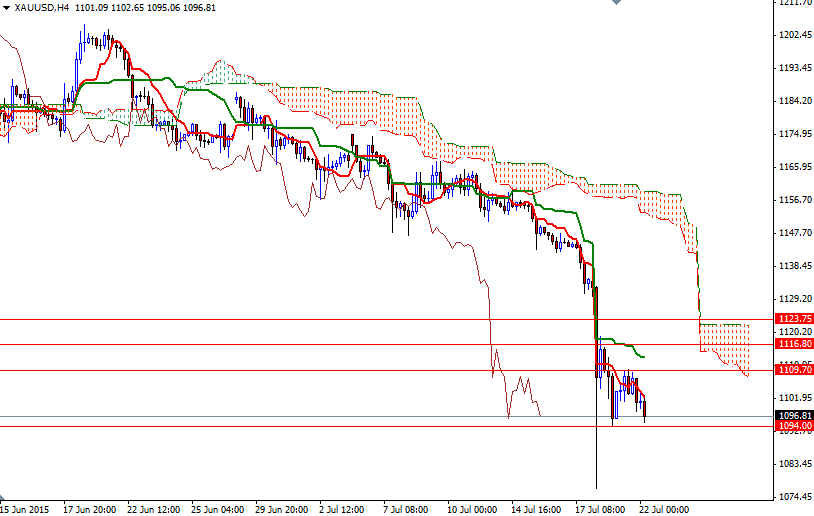

Gold closed up 0.3% at $1100,81 an ounce yesterday, after plunging to the lowest level in five years on Monday, as the dollar took a breather from its recent rally. The XAU/USD pair tried to pass the 1109.70 resistance but the bulls ran out of steam and as a result the precious metal trimmed a portion of initial gains. The market has been suffering due to a bunch of negative factors such as Fed's willingness to move away from its zero-rate policy later this year, slowing growth in China and heightened appetite for riskier assets.

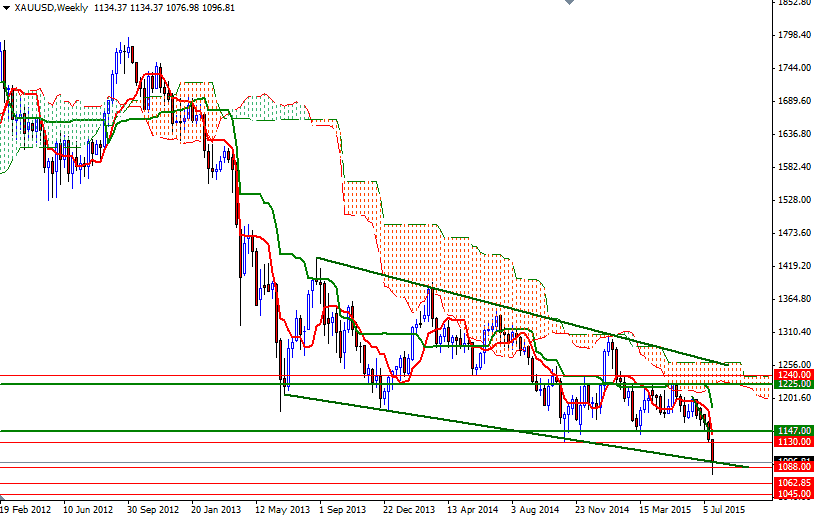

As I pointed out earlier this month, gains will be temporary when the wider environment remains relatively unfriendly for gold. It seems that the dollar rally has more room to run over the long-term therefore expecting gold prices to drop all the way back to the 1000 - 980 area would not be so unrealistic. In the meantime, I will be watching the 1094 and 1109.70 levels.

The XAU/USD pair is trading below the Ichimoku clouds on almost all time frames and the Tenkan-Sen (nine-period moving average, red line) and the Kijun-Sen (twenty six-period moving average, green line) lines are negatively aligned. Sellers will need to shatter the support around 1094, so that they can challenge the bulls on the 1088/6 battlefield. If the bears clear this support, there will be little to slow down their progression until the 1071 level. The first hurdle gold needs to jump is located in the 1003.90 - 1001 region. The bulls have to pass through this barrier if they intend to revisit 1109.70. If the bulls overcome the resistance at 1109.70, they may have a chance to proceed to 1116.80.