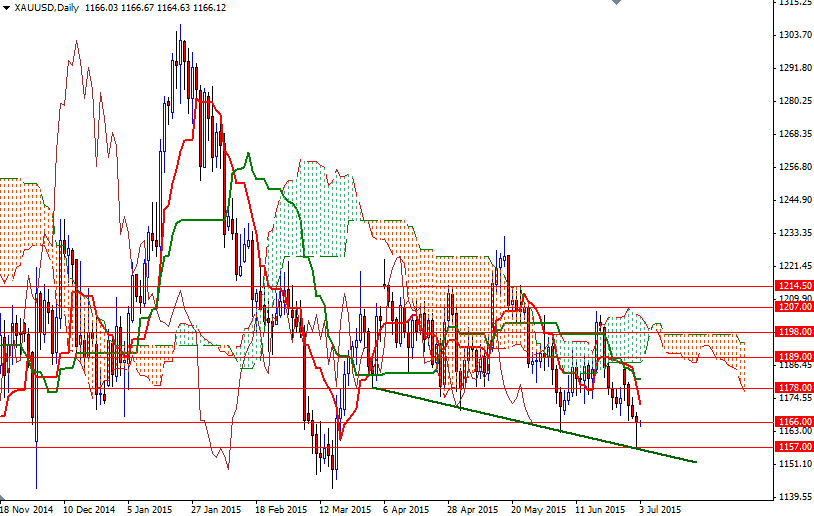

Gold prices initially fell on Thursday but the market found enough support at the $1157 level and formed a hammer. Gold rebounded from the lowest level since March 18 after some disappointing economic data from the U.S. raised some doubts over whether the Federal Reserve will start hiking interest rates as early as September. The Labor Department reported that the economy gained 223000 new jobs in June, less than expectation of 231000, and the unemployment rate fell to a seven-year low of 5.3%. Data also showed that average hourly wages were unchanged and gains for the prior two months were revised down by a total 60K. Weekly jobless claims and factory orders figures were also weaker than anticipated.

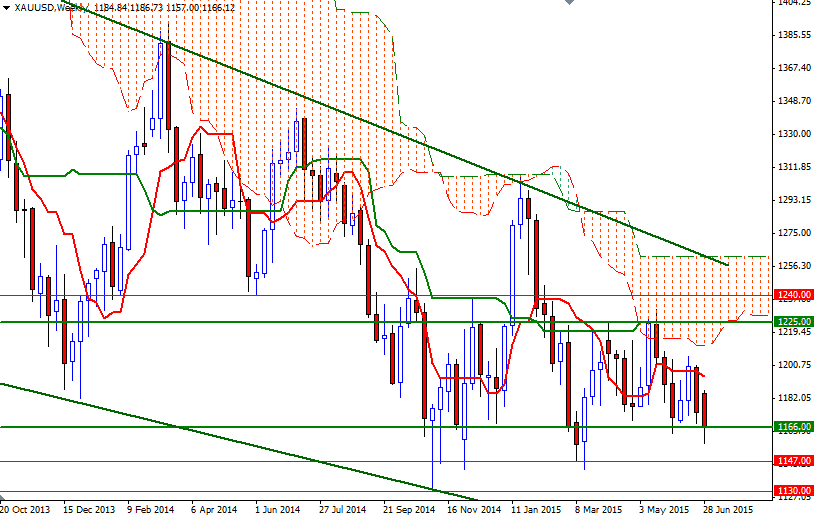

U.S. markets will be closed for the Independence Day holiday and market players are unlikely to take large positions ahead of Greece's Sunday referendum on an international bailout deal. Even though the market has been rather bearish lately, yesterday's hammer shows that there is some buying pressure below. Bouncing off of the short term descending trend line suggests that further downside will be limited. However, a break below the 1157 support could change the situation as it will open a path to 1147.

The XAU/USD pair is wondering around the 1166 level during the Asian session. To the upside, initial resistance levels are located at 1168 and 1172.52. If the market can climb and hold above the daily Tenkan-Sen (nine-period moving average, red line) at 1172.52, it is technically possible to see a push up to the 1179/8 resistance level which happens to be the bottom of the Ichimoku cloud on the 4-hour time frame. The bulls will need to clear this resistance if they intend to approach the next barrier at 1189/7.