The market started the week on the back foot but remained well within the consolidation that we have seen for the past four sessions. Gold prices fell $6.19 an ounce yesterday as the prospect of a September rate hike by the Federal Reserve continued to depress the demand for the precious metal. In the latest economic data, core durable goods orders jumped 0.8% in June. The Federal Open Market Committee begins its two-day policy meeting today, with the markets awaiting clues on the timing of any move by the central bank.

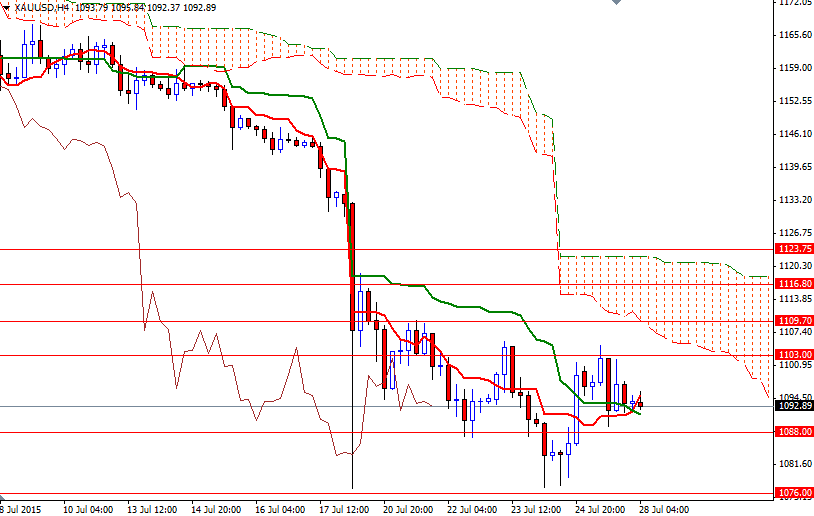

The drop in gold, despite the weakness in the dollar and global equity markets demonstrates that market players have limited interest in gold. However, the XAU/USD pair is holding above the 1088/6 area so far and we have a (weak) bullish Tenkan-Sen (nine-period moving average, red line) and Kijun-Sen (twenty six-period moving average, green line) cross on the 4-hour chart. It looks like the market is going to make a trip back up to the 1105/3 resistance zone, as long as the aforementioned support remains intact. The Ichimoku clouds reside just above the 1105 level so expect bearish pressure to increase as prices approach.

That said, the bulls will have to push prices above 1105 so that they gather enough strength to challenge the bears at the 1109.70 level. If the market clears the resistance at 1109.70, we might see prices marching towards the 1116.80 level. As told earlier, I think the 1088/6 region will be the key to downside. A break below 1086 might trigger a drop towards the critical 1076/1 zone which hindered sellers' progression last week. If this support is broken, then the next stop might be 1062.85.