Gold prices fell $4.32 an ounce yesterday, down for the fourth straight session to $1145.06, as growing perception that the Fed will begin to increase interest rates in September continued to weigh on the market. In economic news on Thursday, the Labor Department's data showed initial claims for state unemployment benefits fell 15K to 281K. Strength in the U.S. dollar and stock markets gives investors few reasons to hold safe-haven investments such as gold.

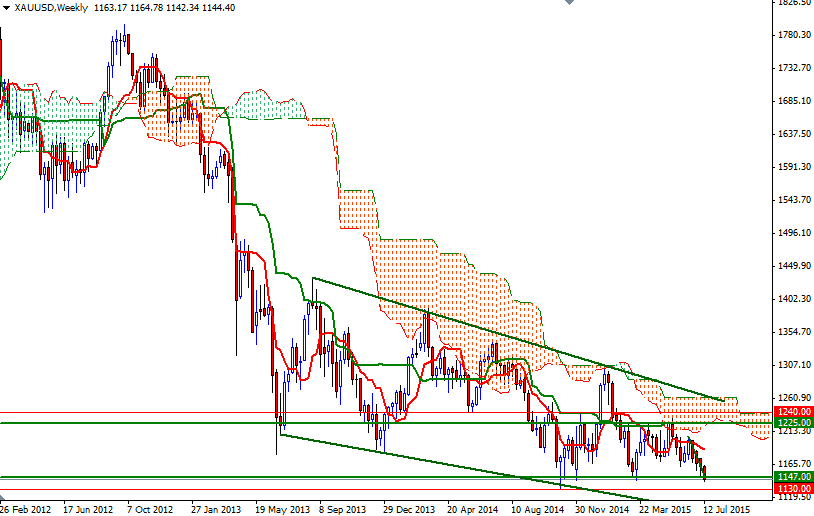

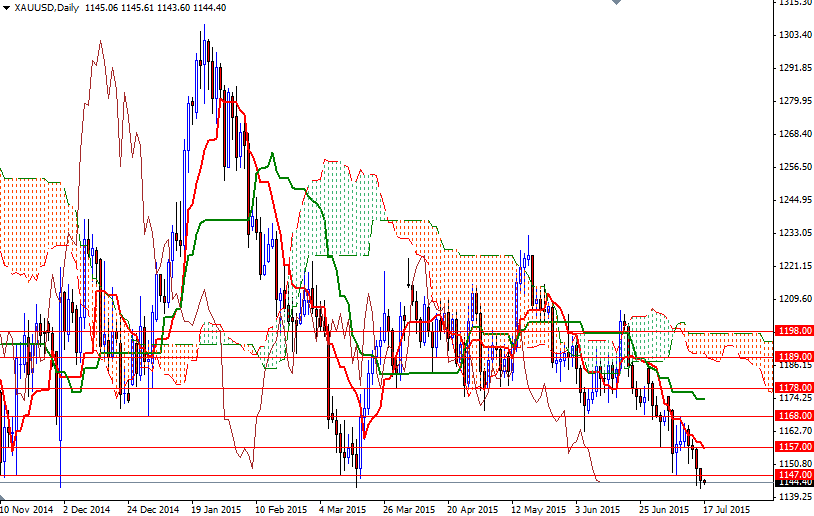

As I repeated in my quarterly and monthly analysis, trading below the Ichimoku clouds on the weekly and daily charts suggest that the broader directional bias remains weighted to the downside. Plus, the XAU/USD pair has been running in a descending channel since July 2013. To the downside, the initial support stands in the 1140/38 region and then nothing stands out until 1133/0. If the bears increases the downward pressure and prices fall through, we will probably see the market testing the next support at 1114.

However, if the bulls manage to dodge incoming attacks and prices start to rise, we might see some resistance at 1147. Buyers will need to break through 1147 so that they make an assault on the next barrier at the 1154 level where the Kijun-Sen (twenty six-period moving average, green line) on the 4-hour time frame and a short-term descending trend line intersect. Just above that, the bears will be waiting at 1157 and 1162 (the top of the Ichimoku cloud on the 4-hour chart).